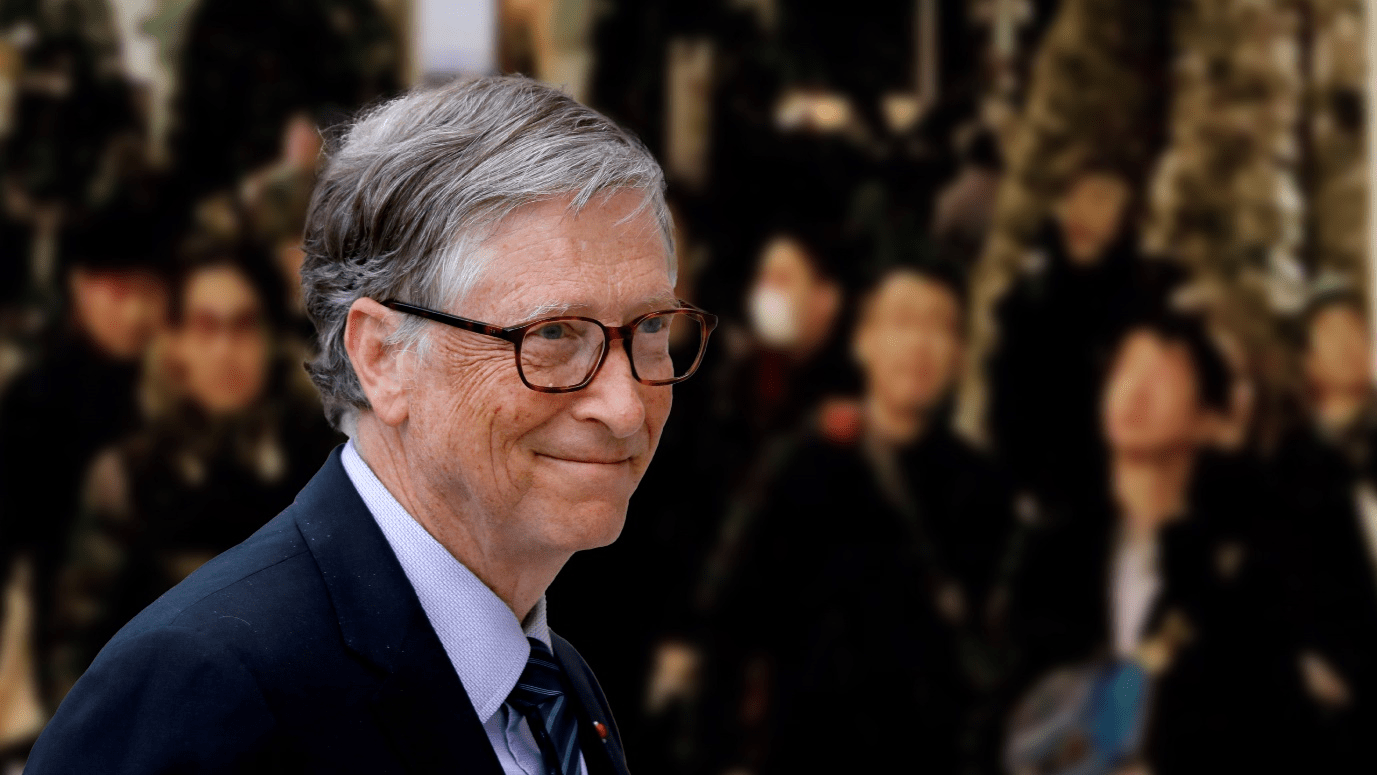

October 22, 2021: -Bill Gates, the fourth-wealthiest person in the world, doesn’t need to make money by investing in climate change. But for those who look to strike it rich, Gates sees plenty of opportunities.

In an interview that aired on Wednesday as part of the virtual SOSV Climate Tech Summit, Gates said future returns in climate investing would be comparable to what the biggest tech companies have produced.

“There will be eight Teslas, 10 Teslas,” Gates said. “And only one of them is, is well known today.”

The electric car company led by Elon Musk has doubled in value in the past year and is up more than 2,000% in the past five years.

“For the winners, anybody investing in Tesla is feeling very smart,” Gates said.

He predicts the gains will be spread out a wider swath of companies.

“There will be Microsoft, Google, Amazon-type companies that come out of this space,” Gates said.

Gates co-founded Microsoft in 1975, while Amazon and Google were launching in the 1990s as the internet was taking off. They’re three of the four most valuable U.S. companies. Currently, Gates is worth $134.3 billion, according to Forbes.

SOSV is a Princeton, New Jersey-based venture capital firm that invests in early-stage climate-tech start-ups.

Gates invests in cleantech through Breakthrough Energy Ventures, which counts Amazon founder Jeff Bezos, Michael Bloomberg, and Ray Dalio as investors.

While Gates is bullying sector, he says that a lot of money will get washed away, just as did when the internet bubble popped, which added that today it’s “such as the early days of software and computing.”

Gates said much of the technology is “at the lab level” and that investors will need to be careful in assessing the economic viability of the idea.

Many of the projects will need a lot of investment before they can be proven to work.

Some things such as nuclear fusion, nuclear fission, and energy storage require “hundreds of millions or, in the case of nuclear, billions” of dollars to test out, he said. “You’re not quite sure whether” those technologies are “going to be able to contribute or not,” he said.

In addition to hefty capital commitments, climate tech needs governments to set “encouraging policies” that facilitate the adoption of zero-emissions technologies, he said.

Investors who want to put money into the space with lesser risk “can be part of financing solar fields,” he said.

The difficult markets to predict are direct air carbon capture, hydrogen, steel, and aviation fuel.

“We will have a high failure rate,” Gates said. But there will be enough ideas that “we have a likelihood of substantial success,” particularly with the proper government assistance, he said.

“Somebody who can’t afford risk or if you expect near term returns it’s, you know, I would look elsewhere,” Gates said.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy