March 22, 2022: -Berkshire Hathaway said Monday morning it agreed to buy insurance company Alleghany for $11.6 billion, or $848.02 per share, in cash. The Omaha, Nebraska-based conglomerate said the deal “represents a multiple of 1.26 times Alleghany’s book value at December 31, 2021,” and a 16% premium to Alleghany’s average stock price in the past 30 days. The deal is expected to close in the fourth quarter of this year.

This transaction would mark Berkshire’s most significant acquisition in six years when the conglomerate bought industrial company Precision Castparts for $37 billion, including debt.

Through its subsidiaries, New York-based Alleghany is involved in several insurance businesses, including wholesale specialty, property and casualty, and reinsurance.

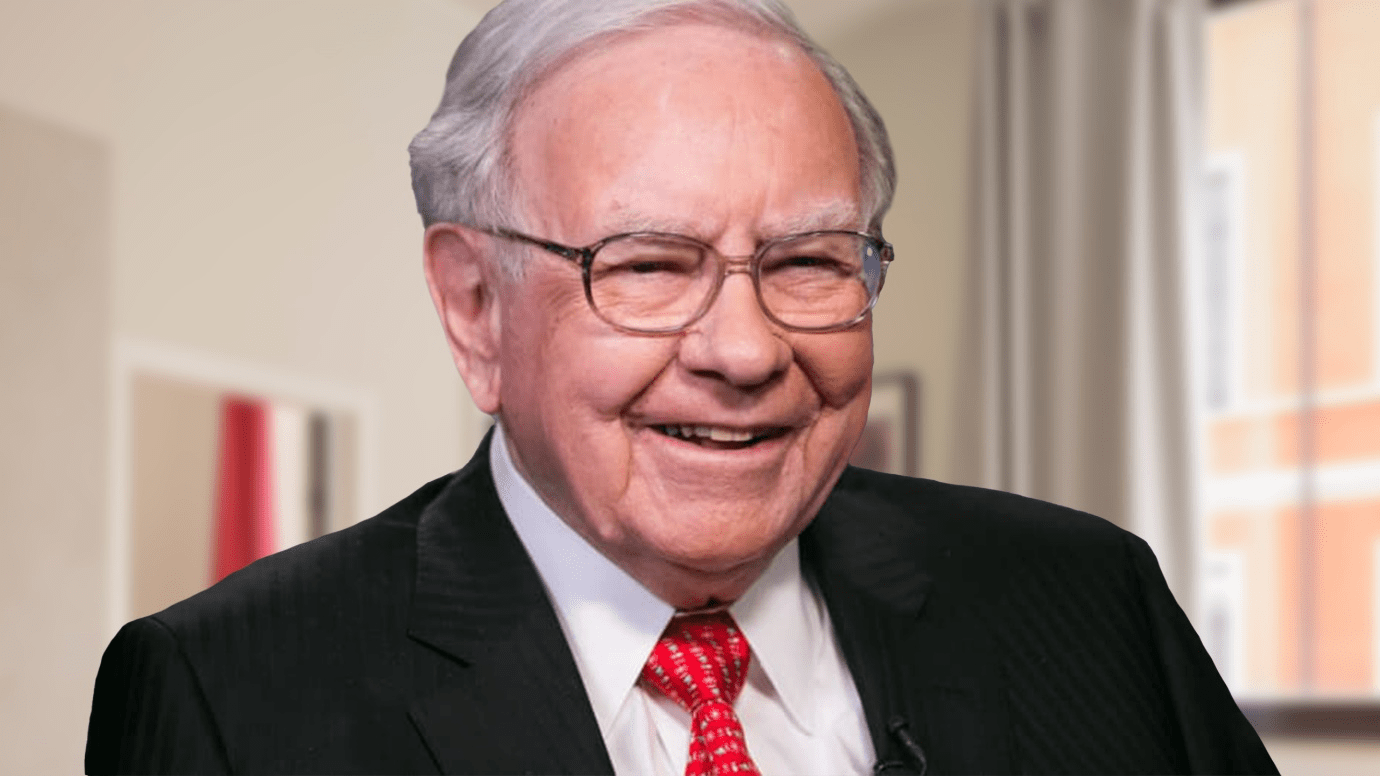

“Berkshire will be the perfect permanent home for Alleghany, a company I have closely observed for 60 years,” Buffett, Berkshire’s chairman and CEO, said.

Insurance is one of Berkshire’s bread-and-butter businesses as it already owns Geico auto insurance, General Re reinsurance, and others that have been driving growth in recent years.

Alleghany CEO Joseph Brandon, who led General Re, hailed the deal as a “terrific transaction for Alleghany’s owners, businesses, customers, and employees,” noting that “the value of this transaction reflects the quality of our franchises and is the product of the hard work, persistence, and determination of the Alleghany team over decades.”

Alleghany and its units will operate independently after the deal closes.

The deal may surprise some Berkshire shareholders, as Buffett and his right-hand man Vice Chairman Charlie Munger, have expressed frustration searching for a significant acquisition. In his 2022 annual letter to shareholders, Buffett said he and Munger found little that “excites” them in terms of large deals.

“Throughout 85 years, the Kirby family has created a business similar to Berkshire Hathaway,” Buffett said. Jefferson W. Kirby is chair of the Alleghany board of directors.

Alleghany started in 1929 as a holding company for railroads and eventually pivoted to insurance, which parallels Berkshire’s roots as a textile manufacturing company more than a century ago before it became a multifaceted conglomerate.

To be sure, $11.6 billion is a small number compared with Berkshire’s massive cash hoard of $146.72 billion at the end of 2021.

“This is Berkshire’s largest full acquisition in a while, although the amount being spent ($11.6B) is relatively small and certainly doesn’t constitute the type of ‘elephant deal’ Buffett has repeatedly talked about,” Adam Crisafulli of Vital Knowledge said in a note.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy