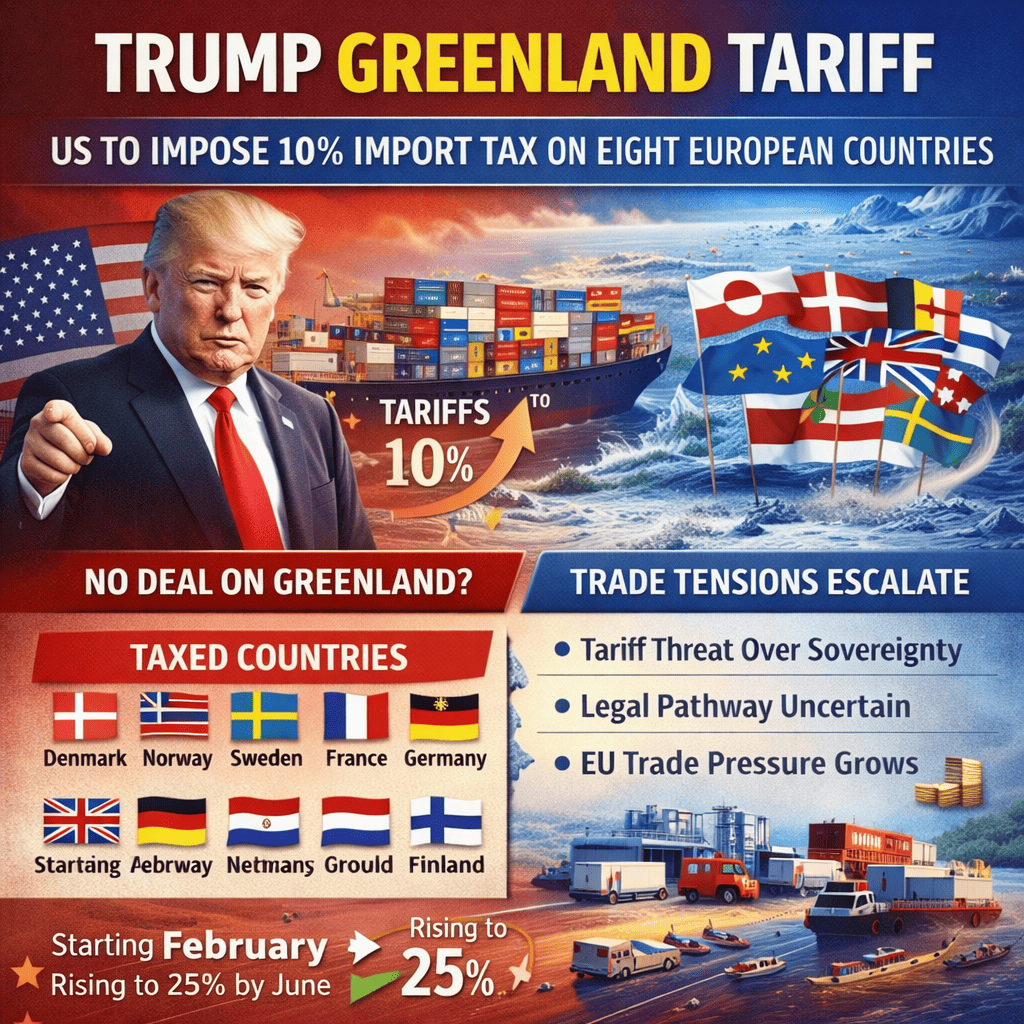

The Trump Greenland tariff is set to reshape transatlantic trade relations after President Donald Trump announced that the United States will impose a 10% import tax on goods from eight European countries beginning 1 February. The move is directly tied to Denmark’s refusal to engage in discussions over the sale of Greenland. Trump warned that the tariff would rise to 25% by 1 June unless “a complete and total purchase of Greenland” is agreed.

The countries targeted by the Trump Greenland tariff are Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. The White House framed the measure as a response to what it called coordinated European pressure in the Arctic, following recent visits by officials from several of these states to Greenland. For European capitals, the announcement transforms a geopolitical dispute into an economic weapon.

Unlike traditional trade disputes rooted in market access or subsidies, the Trump-Greenland tariff is explicitly political. It links trade penalties to territorial negotiations, placing a NATO ally under economic pressure over sovereignty. European officials argue that this crosses a line, turning tariffs into leverage over national decision-making rather than commercial conduct.

The legal pathway for the tariff remains uncertain. US officials have not clarified whether the duties would be introduced under standard trade law or through emergency economic powers. That ambiguity matters for businesses. It increases the likelihood of abrupt changes—such as sector carve-outs, reversals, or rapid escalations—rather than a predictable policy cycle.

Trump has framed Greenland as strategically indispensable, citing Arctic security, missile defense, and rising Russian and Chinese interest in the region. Danish and Greenlandic leaders reject the premise that the territory is for sale. Demonstrations in Nuuk and across Denmark underline how politically immovable the issue is domestically.

The Trump Greenland tariff lands on an already fragile EU–US trade ground. European exporters now face the prospect of layered duties on machinery, vehicles, industrial components, and consumer goods. If the tariff stacks on existing measures, margin structures could be disrupted within weeks, not quarters.

For executives, this is not a headline risk—it is an operational one:

- Build tariff stack models by SKU and region to identify margin cliffs under 10% and 25% scenarios.

- Pre-negotiate contract clauses for price adjustments and delivery windows triggered by sudden duties.

- Audit country-of-origin and routing exposure; the Trump Greenland tariff is country-scoped, making documentation decisive.

- Prepare for EU countermeasures that may target procurement, licensing, or services rather than goods alone.

Speculation (flagged): if the Trump Greenland tariff takes effect in February, expect parallel tracks—intense diplomatic outreach and selective exemptions for politically sensitive US imports. Broad tariffs raise domestic input costs quickly, and that pressure often produces carve-outs even when the public posture remains confrontational.

The dispute now sits at the intersection of sovereignty, security, and trade. Whether the Trump Greenland tariff becomes a negotiating tactic or a lasting rupture will define the next phase of transatlantic economic relations.