January 6, 2021:U.S. stock futures were lower early Wednesday morning as Wall Street kept waiting for the results of runoff elections in Georgia that will decide the Senate’s control.

Dow Jones Industrial Average futures were flat, while S&P 500 futures and Nasdaq 100 futures both traded in negative territory.

The benchmark 10-year Treasury note yield, meanwhile, reached 1% for the first time since March.

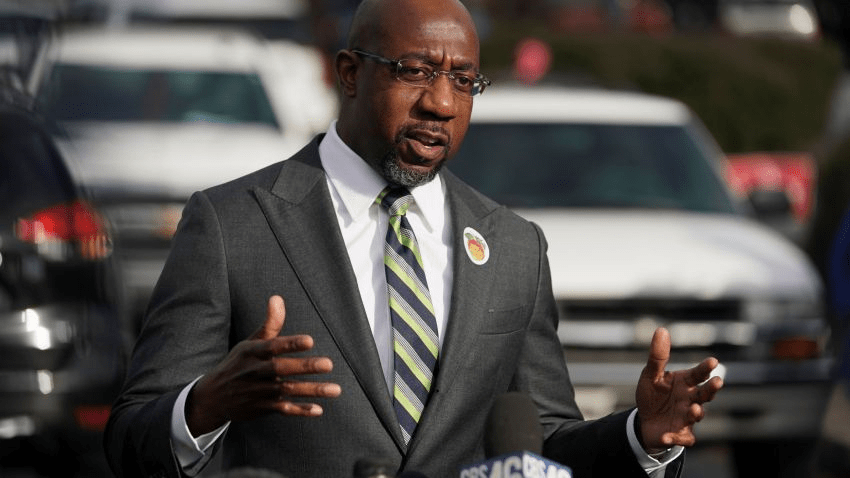

If both Democrats win, that will make a tie in the upper chamber, with Kamala Harris as the tiebreaker vote to give the party control of the Senate.

“Consensus seems to believe that if Dems win both seats, this is negative for stocks because of the risk of higher taxes,” said Tom Lee, head of research at Fundstrat Global Advisors, in a note.

“The best the Democrats can do is a 50-50 split in the Senate, and their caucus includes some moderates who would not necessarily vote for all of Biden’s policy proposals,” said Haefele in a note. “Another point to consider is that there will be a midterm election in 2022, and the sitting president’s party typically loses seats in Congress.”

“Democrats will have to fear that if they are too aggressive in forcing their agenda through Congress on a strictly partisan basis, they could potentially lose their majorities in both houses,” Haefele said.

The Dow rose 0.6% on Tuesday. The S&P 500 and Nasdaq Composite advanced 0.7% and nearly 1%, respectively. Those gains came as traders made bets on the global economy recovering, driving crude prices and energy names higher.

December ADP employment change data is due out at 8:15 a.m. ET, followed by last month’s figures from Markit’s composite and services purchasing managers’ index. Month-on-month factory orders data for November is also expected to come out.

Weekly EIA stock change data for gasoline, crude oil, Cushing oil, and distillate is due to be released.

Minutes from the U.S. central bank’s last Federal Open Market Committee meeting are set to be published.

Auctions will be held Wednesday for $25 billion of 105-day bills and $30 billion of 154-day bills.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy