April 21, 2021: – Ireland’s low corporate tax rate comes in the spotlight again as Joe Biden revamps the global tax landscape. The country’s rate of 12.5% has been a prime feature to attract dozens of big companies, especially U.S. tech and pharmaceutical firms, to its shores, often doing many jobs.

Ireland’s tax system has attracted much ire, mainly in the 13-billion-euro Apple tax tussle with the European Commission.

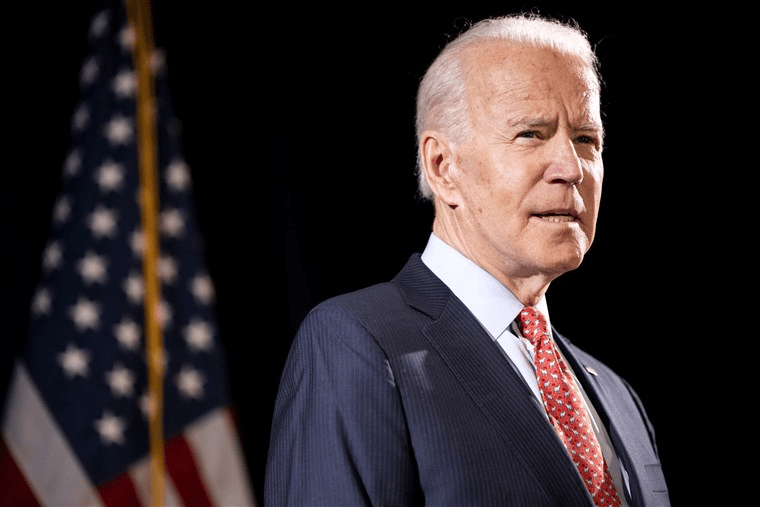

Biden’s plan, which proposes a global minimum tax rate, has reignited the flame. At the same time, Treasury Secretary Janet Yellen said that the “race to the bottom” on corporate tax rates needs to finish.

Consensus on tax is a competition that is going on for years, primarily through the negotiations at the OECD over a global minimum corporate tax rate and the various efforts by national governments to bring on the digital taxes.

Biden’s proposals haven’t presented anything that has not been proposed before, and there is a greater thrust behind it this time, Alex Cobham, the chief executive of advocacy group the Tax Justice Network, told CNBC. “We are very positive about what the Biden administration has done, partly as much for the big narrative shift as for the detailed policy,” he added.

If the corporate tax landscape is altered, it will affect Ireland, which has stood firmly by its 12.5% rate for many years. Corporate tax receipts totalled 11.8 billion euros in the previous year.

“We are constructively engaged in these discussions and will consider any proposals carefully, noting that political level discussions on these issues have not yet taken place with the 139 countries involved in this process,” a spokesperson for Ireland’s Department of Finance said.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy