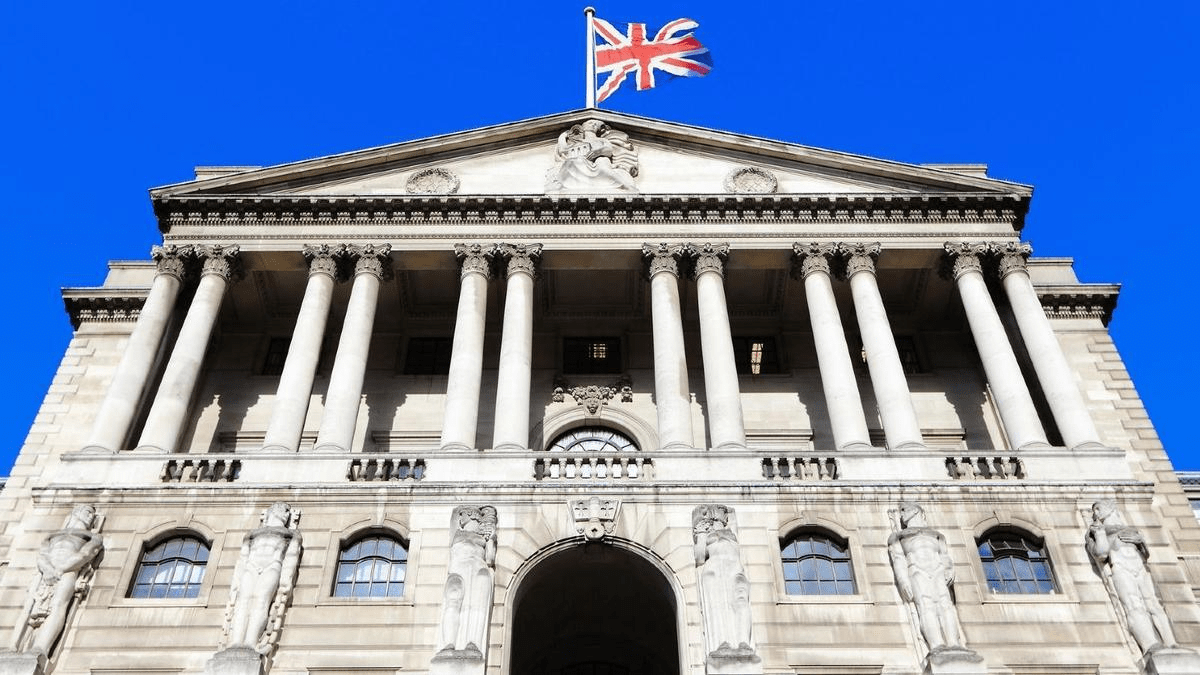

June 25, 2021: On Thursday, the Bank of England kept its monetary policy unchanged but vowed to monitor increasing inflation as the U.K. economy emerges from its Covid-induced slump.

The Monetary Policy Committee voted unanimously to keep the primary lending rate at a historic low of 0.1%. In addition, a majority voted to maintain asset purchases at the current level of £895 billion.

The Bank noted that “developments in global GDP growth have been stronger than anticipated, in advanced economies” since its last report in May.

It added that global price pressures have picked up more but suggested that financial market measures of inflation expectations prove that this near-term strength is expected to be transitory.

It began that the committee’s central expectation is that the economy will experience a temporary period of solid GDP growth and above-target inflation, “after which growth and inflation will fall back.”

However, it further said, “There are two-sided risks around this central path, and it is possible that near-term upward pressure on prices could prove somewhat larger than expected. Nevertheless, taking together the evidence from financial market measures and surveys of households, businesses, and professional forecasters, the Committee judges that U.K. inflation expectations remain well-anchored.”

The MPC had not altered its policy settings since Nov. 5, 2020, when it increased its bond-purchase target from £745 billion to its current £895 billion, while the 0.1% Bank Rate has remained unchanged since the month of March 2020.

U.K. consumer price inflation came in at 2.1% in May, which exceeds forecasts and surpassing the Bank’s 2% target for the first time in nearly two years, while core inflation increased from 1.3% in April to 2% in May.

On Thursday, while the market was not expecting any changes to the policy, the view of inflationary pressures of the Bank and clues about its future tightening schedule were in sharp focus. According to the last meeting, these CPI figures represented a sharper incline than previously expected by the Bank.

Last week, the U.S. Federal Reserve surprised the market with a hawkish shift, upping its inflation expectations and brought forward its rate hike schedule to project two increases in 2023.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy