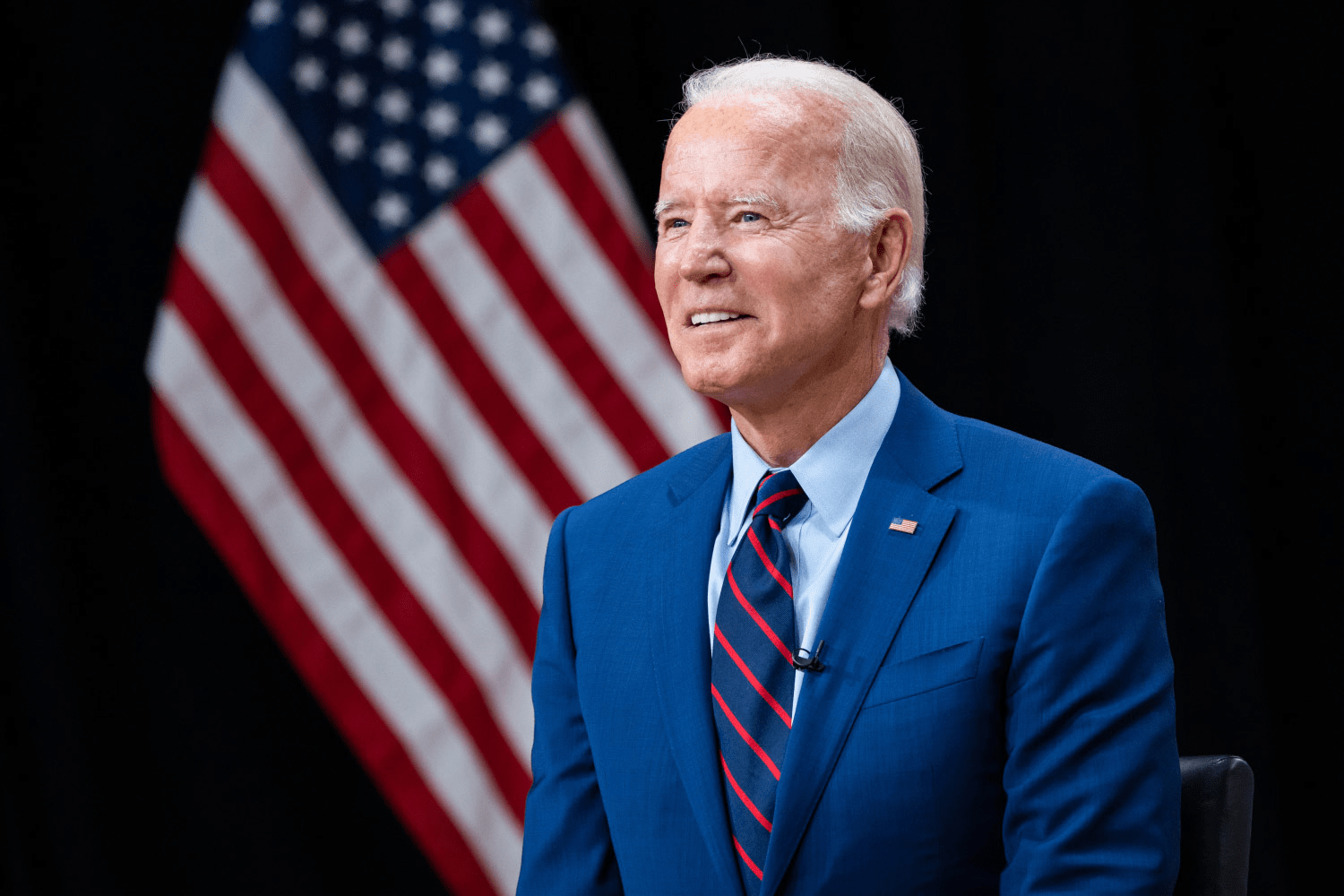

April 26, 2021: -President Joe Biden will seek to increases taxes on millionaire investors to fund education and other spending priorities as the administration’s effort to overhaul the U.S. economy. As the plan includes, Biden will seek a raise in the tax on capital gains to 39.6% from 20% for those Americans earning over $1 million, according to multiple outlets, that include Bloomberg News and The New York Times.

The capital gains tax is significant to Wall Street since it dictates how large the federal government collects a chunk of an equity sale. The White House refused to comment.

Stocks slid on the news about the plan, with the S&P 500 Index down 1% as of 2:14 p.m. after increasing 0.2% earlier. The Dow Jones Industrial Average and Nasdaq Composite both retreated by the same kind of magnitude.

The proposal would make good on Biden’s campaign promise to require America’s affluent households to provide more percentage of their income. This plan would bring the capital gains tax rate and the top individual income tax rate, presently at 37%, to near parity.

According to the reports, the president is expected to release the proposal formally next week to fund spending in the future American Families Plan, scheduled to come in nearly $1 trillion.

The American Families Plan will include measures aiming to help the U.S. workers learn new skills, expand childcare subsidies, and make community college tuition accessible for all people.

That proposal is different from the $2.3 trillion infrastructure package known as the American Jobs Plan, funded by a rise in the corporate tax rate up to 28%. The White House and Democratic lawmakers passed a $1.9 trillion Covid-19 relief package in March.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy