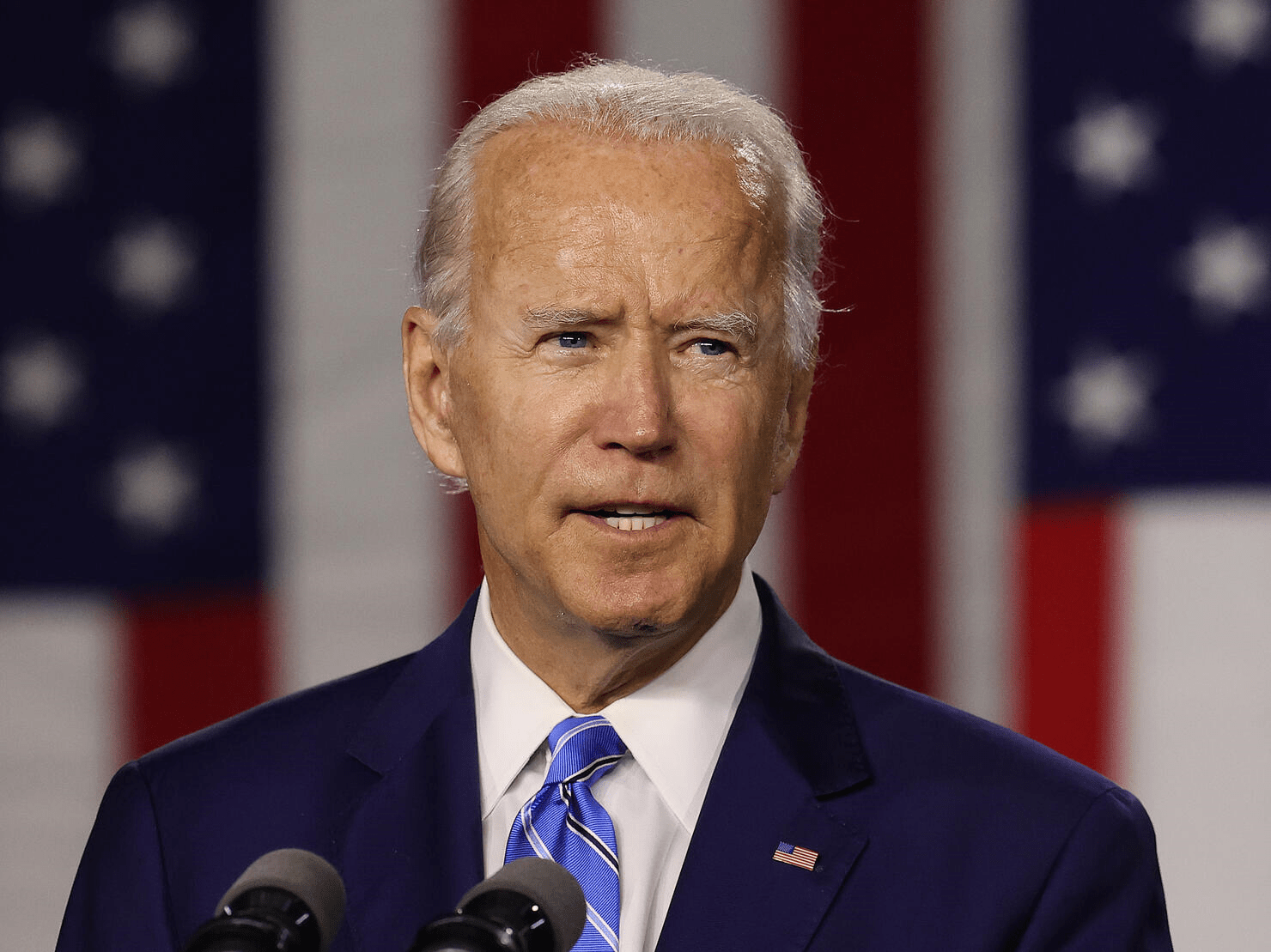

April 29, 2021-On Wednesday, President Joe Biden will pitch Congress on $1.8 trillion in new spending and tax credits pointing toward children, students, and families, senior administration officials said.

Biden will reveal the massive new package more petite than a month after the White House issued a sweeping proposal to spend over $2 trillion in eight years on infrastructure and other projects.

The new proposal, including about $1 trillion in investments and $800 billion in tax credits in a decade, will be fully offset in 15 years in part by increasing the amount of taxes paid by the wealthiest Americans, the White House said.

Some of its new plans include $225 billion toward high-quality child care and ensuring families pay only a portion of their income toward child-care services and another $225 billion to make a national comprehensive paid family and medical leave program.

$200 billion for the free universal preschool for all 3- and 4-year-olds, offered through a national partnership with states and $109 billion toward ensuring two years of free community college for all students.

A $62 billion grant program to raise college retention and completion rates and a $39 billion program provides two years of subsidized tuition for students from families whose incomes are below $125,000.

$45 billion to meet the child’s nutritional needs, including expanding access to the summer EBT program, which helps some low-income families with children buy food outside the school year.

$200 billion to make permanent the $1.9 trillion Covid stimulus plan’s provision lowering health insurance premiums for those purchasing the coverage on their own

Extending through 2025 and making it permanently fully refundable, the child tax credit expansion included in the Covid relief bill and the recent development of the child and dependent care tax credit.

The plan would also seek to close a series of tax loopholes and raise taxes on capital gains to 39.6% for households above $1 million.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy