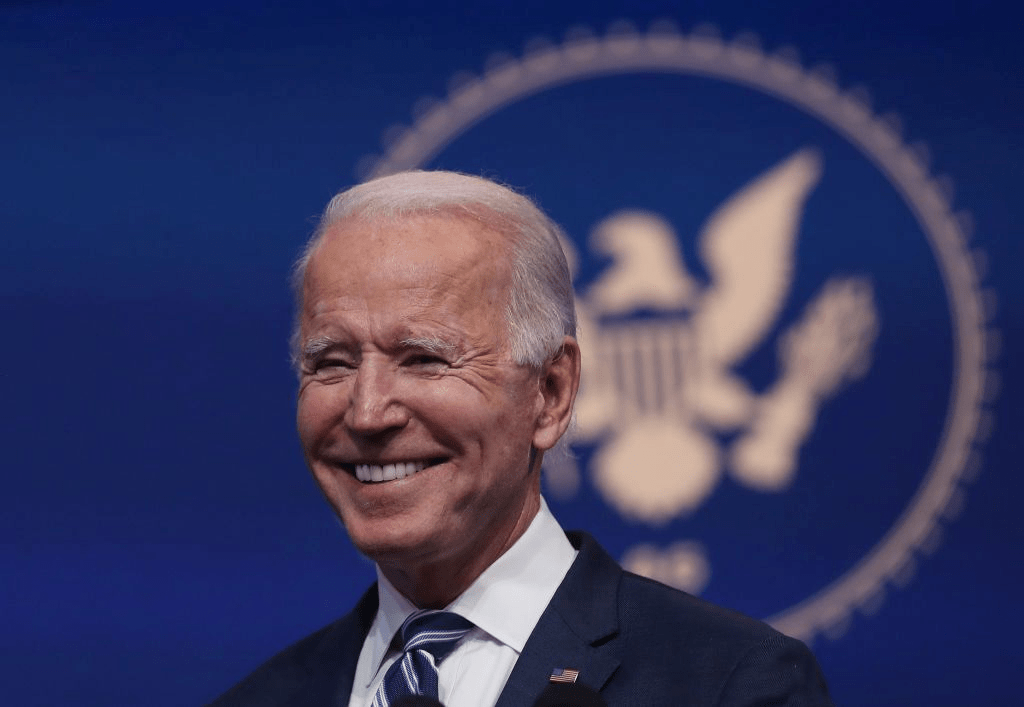

June 4, 2021: -President Joe Biden wants to increase the top income tax rate for wealthy households to 39.6%, from the present 37%, to help finance his legislative agenda.

On Friday, according to a budget proposal issued by the Treasury Department, that top rate would apply to single individuals with taxable income of above $452,700 and married couples filing a joint tax return with income above $509,300.

It would also apply to heads of household with an income that exceeds $481,000 and filing separate tax returns with income over $254,650 for married individuals.

The income thresholds are less than under current law, set by the 2017 Tax Cuts and Jobs Act.

The 39.6% top rate would kick in the year 2022 tax year, according to the proposal. That means it would apply to tax returns filed in the year 2023. Congress would still need to pass legislation that enacted the policy, which isn’t assured.

Biden’s proposal is one of several measures to raise taxes on households earning than $400,000 a year.

The tax revenue would help finance initiatives in the American Families Plan to expand the social safety net, which includes funding for four additional years of free schooling, heavily subsidized child care for average families, federal paid family leave, and expanded child tax credits.

According to the Treasury Department, hiking the top rate to 39.6% would raise an estimated $132 billion over five years.

The top rate is slated to increase even if Congress doesn’t pass Biden’s proposal. The Tax Cuts and Jobs Act’s tax reductions will lapse after 2025 due to how Congress structured the law.

According to a Treasury official, Biden’s proposed income thresholds for the 39.6% rate correspond to the pre-TCJA entries, indexed for inflation.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy