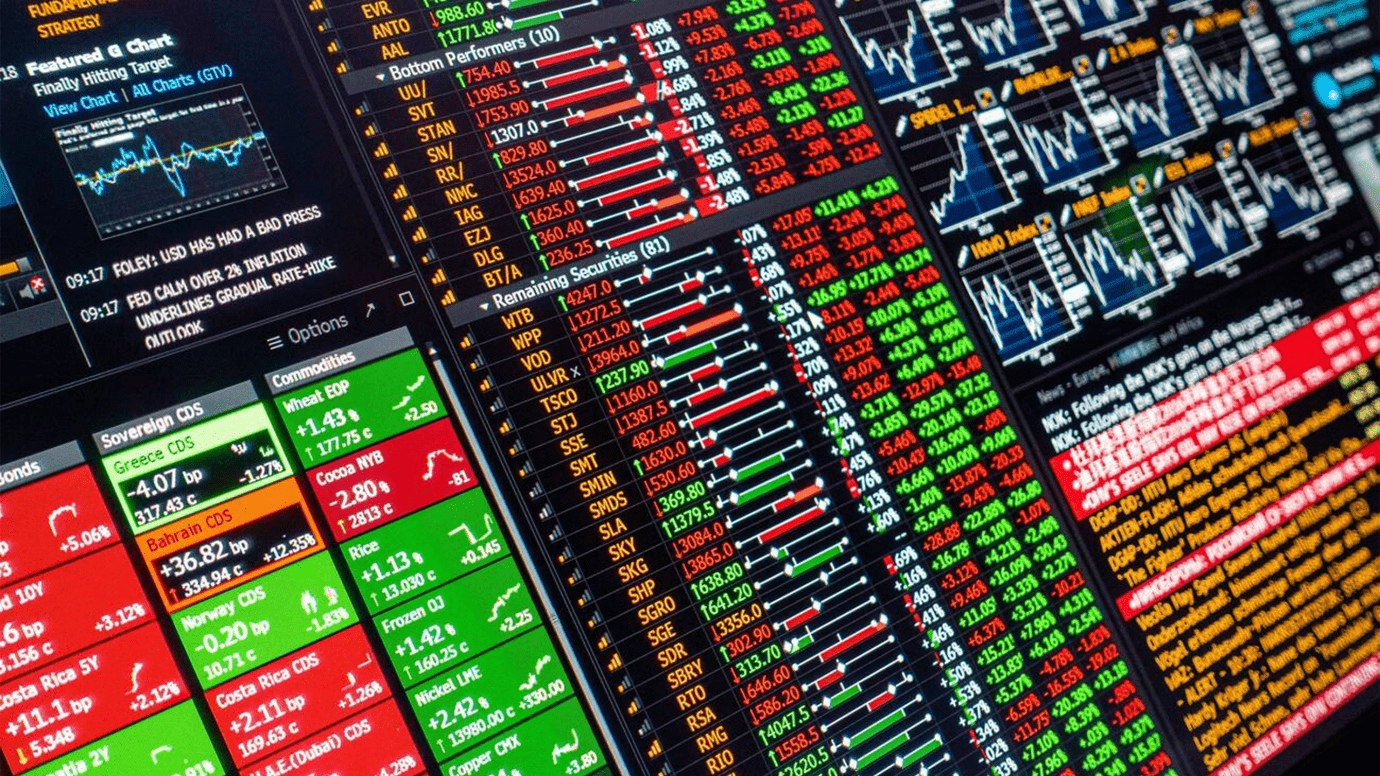

February 21, 2023: On Thursday, Britain’s FTSE 100 index shut down by nearly 8,000 points for the first time, with one analyst suggesting the reason behind the demand for U.K. products is that “boring is sexy.”

Instead of the U.K. facing the weakest economic developed outlook among the world’s major economies, including Russia, the country’s blue-chip index reached record highs this week and closed at 8,012.53.

After a rough year in 2022, as increasing inflation, steep interest rate hikes, and faded consumer confidence torched stock markets nearly the world, the U.K. market started Friday’s trade up 7.5% in 2023. However, that remains behind the 9.5% gain on the pan-European Stoxx 600 index.

On Friday, the FTSE 100 decreased 0.25% by mid-morning in London as risk assets sold off all over Europe, though the losses were considerably lesser than those seen in France and Germany.

“Currently, the U.K. and Europe are in an inflation sweet spot; it’s not exactly which cools quickly, but it is being cold much quicker than many had expected,” said Danni Hewson, head of fiscal analysis at British investment platform A.J. Bell.

“That’s creating confidence that consumers might have enough to get by; that those controversial profits enjoyed by those energy giants won’t hang all over forever due to the price of energy falling fast.”

The U.K.’s annual headline inflation is under for a third month in the previous month at 10.1%, though it stays well over the Bank of England’s 2% aim while the labour market remains unusually tight.

Eurozone headline inflation also decreased for a third consecutive month to 8.5% in January, returning to earth slightly faster than in the U.K.

Despite the expected slump, the U.K. and European economies have thus far managed to exceed expectations and stave off a downturn slightly.

The U.K. has benefited somewhat from a return to economic stability following the market turmoil seen in the previous year in the wake of former Prime Minister Liz Truss’ ill-fated financial plan.

Therefore, the region’s mild weather in northern Europe and increased levels of natural gas storage have experienced the region’s tend to avert the energy shortages for this winter.

Bumper gains in sectors with a heavy weighting in the FTSE 100, like energy, commodities and financials, have also supported propel the index upwards, along with a weak pound helping overseas payments collected in dollars.

The index comprises multinational firms with surged proportions of dollar-denominated revenues and offers comparatively high premium payments for investors.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy