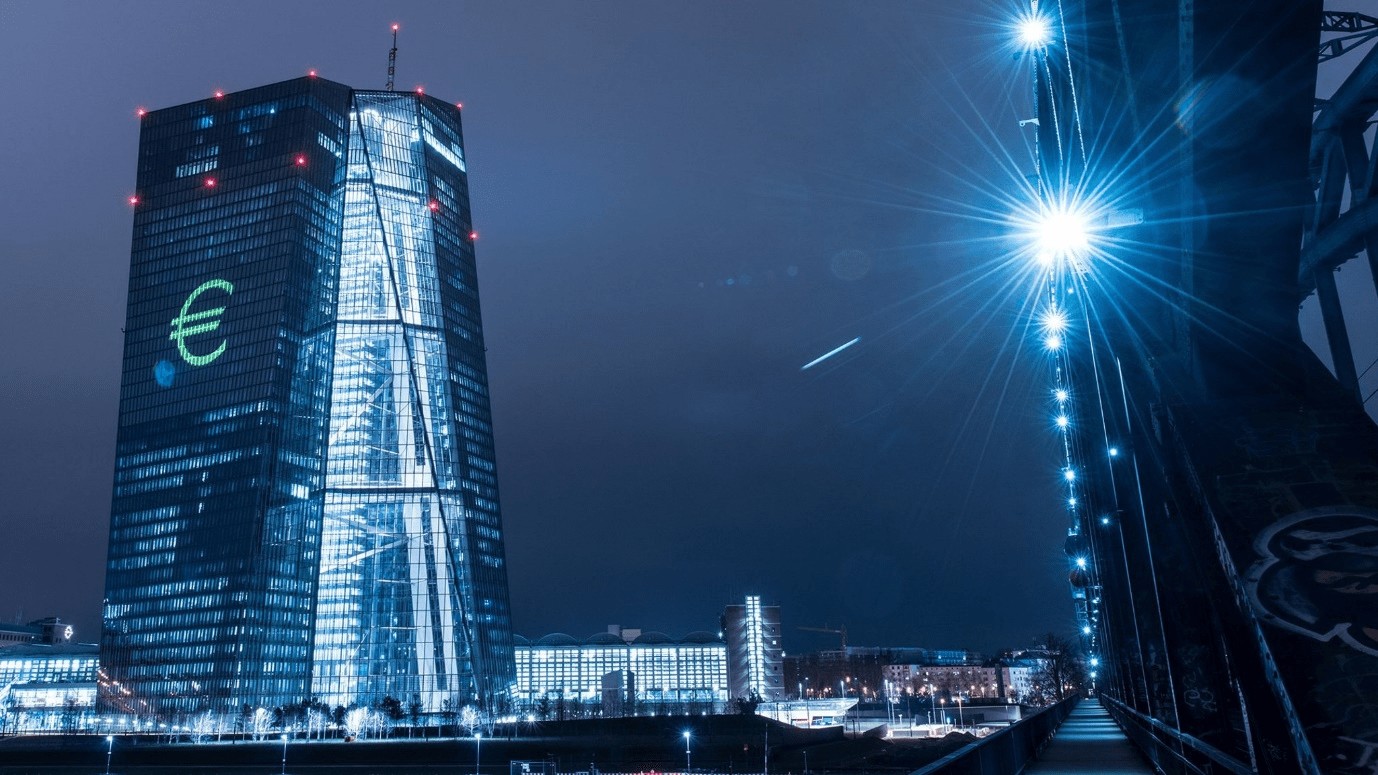

April 23, 2021: -On Thursday, the European Central Bank decided to keep its policy unchanged while market players look for clues when its massive monetary stimulus can begin to be wound down.

“The Governing Council will reconfirm its very accommodative monetary policy stance,” the ECB said on Thursday.

Last month, the central bank said it was going to increase government bond purchases to address rising bond yields in the eurozone. At the time, the ECB expressed concerns with borrowing costs rising sharply for euro area governments before the economy has fully recovered from the coronavirus shock.

As a result, data from Deutsche Bank showed the ECB purchased 74 billion euros in bonds in March, up from 53 billion and 60 billion euros in February and January.

“The Governing Council expects purchases under the PEPP over the current quarter to continue to be conducted at a significantly higher pace than the first months of the year,” the ECB said on Thursday.

It suggests it will keep buying more bonds in the coming months compared to the first few months of the year. Market players are keenly anticipating the June meeting, the next in the ECB’s calendar, as the next pivotal moment for monetary stimulus in the eurozone.

Hawkish ECB members hope that, as vaccination rates rise and economies slowly reopen, they can start talks on when to ease stimulus. The ECB signaled on Thursday that it would all depend on how financing conditions evolve as well.

“The envelope can be recalibrated if required to maintain favorable financing conditions to help counter the negative pandemic shock to the path of inflation,” the ECB said in a statement.

Market reaction was muted after the announcement, as it met analysts’ expectations of no further action.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy