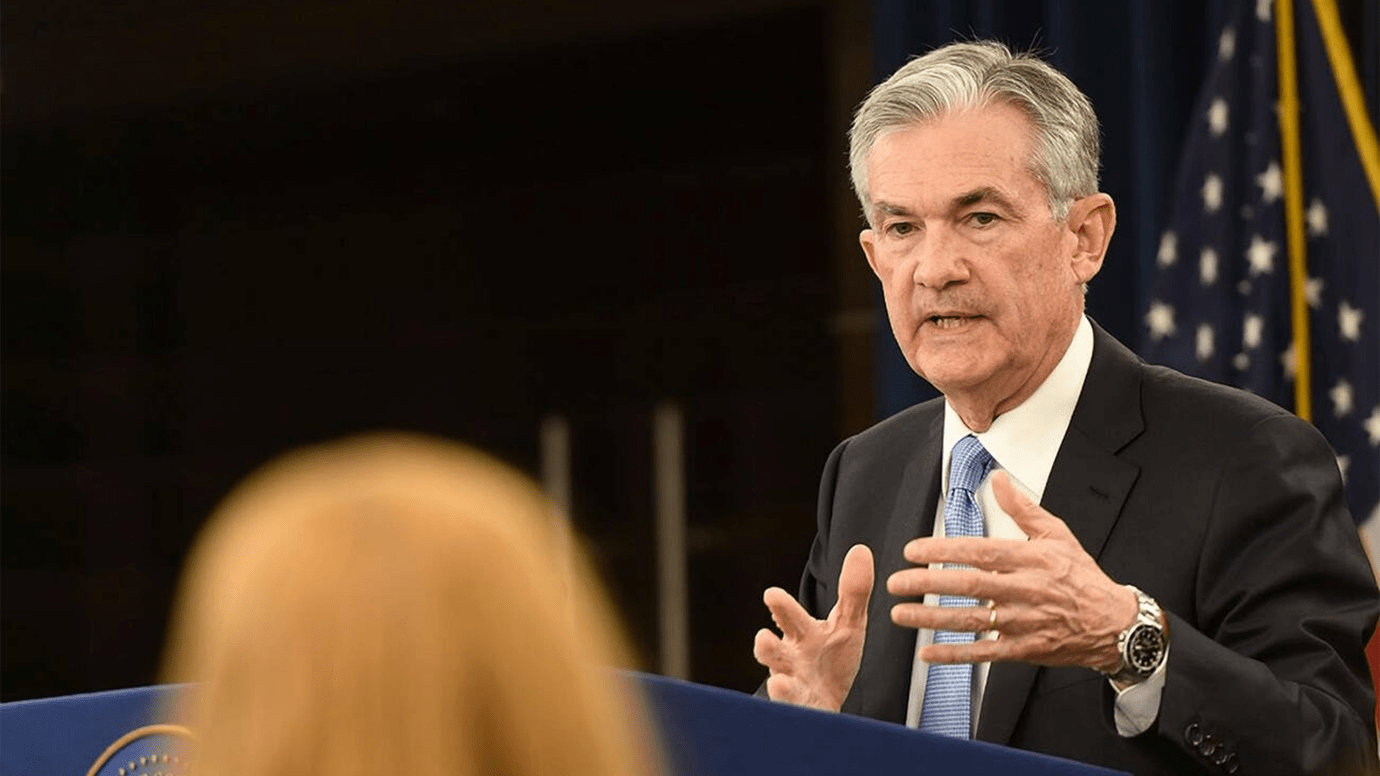

February 9, 2023: On Tuesday, Federal Reserve Chairman Jerome Powell said inflation is beginning to ease. Nevertheless, he expected it to be a long process and cautioned that interest rates could increase over markets anticipate if the economic information doesn’t cooperate.

“The disinflationary trial, the process of getting inflation decrease, has started, and it’s started in the goods sector, which is nearly a quarter of our economy,” the central bank chief stated in an event in Washington, D.C. “But it has a long way. These are the very early stages.”

Powell spoke with Carlyle Group co-founder David Rubenstein in a discussion session at the Economic Club of Washington, D.C. Powell is a retired partner at the firm.

Markets briefly are changing positive as Powell spoke as investors hope the Fed will soon halt the aggressive interest price hikes it began last year. However, the significant averages flipped back to negative after Powell cautioned about robust economic data, such as the previous week’s jobs report for January, before turning positive again.

If it would have influenced the Fed’s prices to call if it had the jobs report before the policy meeting, Powell stated, “We don’t get to play it that way.” The report reveals that nonfarm payrolls increased by 517,000 in January, almost triple the Wall Street estimate.

He stated that if the data shows that inflation is hotter than the Fed expects, that will mean higher prices.

“The reality is we’re going to show to the data,” Powell stated. “So if we keep going to get, for instance, strong labour market reports or higher inflation reports, it may reasonably be the case that we have to do more and raise rates more than is priced in.”

At its most recent meeting, which completes six days ago, the Fed raised its benchmark interest prices by a quarter percentage point, the eighth increase from March 2022 to a target range of 4.5%-4.75%.

In his remarks Tuesday, he did not indicate when the hikes will stop and said it probably will take into 2024 before inflation gets to a point where the Fed feels comfortable. The central bank targets 2% inflation, and it’s currently running well more than that by multiple measures.

“We anticipate 2023 to be a year of huge declines in inflation. It’s our job to make sure that that’s the case,” he said. “My guess is it will certainly take into not just this year, but next year to get close to 2%.”

The Fed looks at a series of data points when examining inflation.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy