November 12, 2021: -On Wednesday, a major winner after electric vehicle start-up Rivian Automotive’s blowout IPO is one of its competitors, Ford Motor.

Ford owns nearly 12% of the company through equity and bond investments that began in 2019, according to public filings by Rivian. Based on Rivian’s closing price of $100.73 a share after its Nasdaq debut, Ford’s 102 million shares of the company, including notes that converted to shares in June, are worth nearly $10.3 billion alone. It purchased its equity stake for an aggregate of $820 million, according to public documents.

When Ford came down $500 million into Rivian in 2019, the companies had plans to develop a vehicle for the Detroit automaker’s Lincoln luxury brand, later abandoned. Ford is receiving a seat on the company’s board, which it has since relinquished.

The actions have led some to question if Ford, going through a multi-billion restructuring, will be a long-term investor in Rivian. Ford has continued to call Rivian a “strategic investment,” which is confirmed again on Wednesday.

“We’ve said that Rivian is a strategic investment, and we’re exploring potential collaborations,” Ford spokesman said to CNBC. “We won’t speculate about what Ford will do, or not, in the future,” the spokesperson added.

Ford CEO Jim Farley, inherently the investment in Rivian from his predecessor, Jim Hackett, tweeting congratulations to Rivian and its CEO and founder RJ Scaringe on Twitter on Wednesday.

Rivian, in its registration statement with the SEC, acknowledged Ford’s investment as potentially which leads to a conflict of interest and a benefit in other ways.

“Accordingly, such stockholders have different business interests than our other stockholders or us, and may take action or vote their shares in a manner that could adversely impact our other stockholders or us,” the company said, which cited both Ford and Amazon, owning about 20% of Rivian.

Ford bought $415 million in convertible notes in July that became common stock in June 2022. According to the documents, the conversion price will be equal to the lesser of $71.03 a share or the IPO price for each share multiplied by the applicable discount rate determined by reference to the time of conversion.

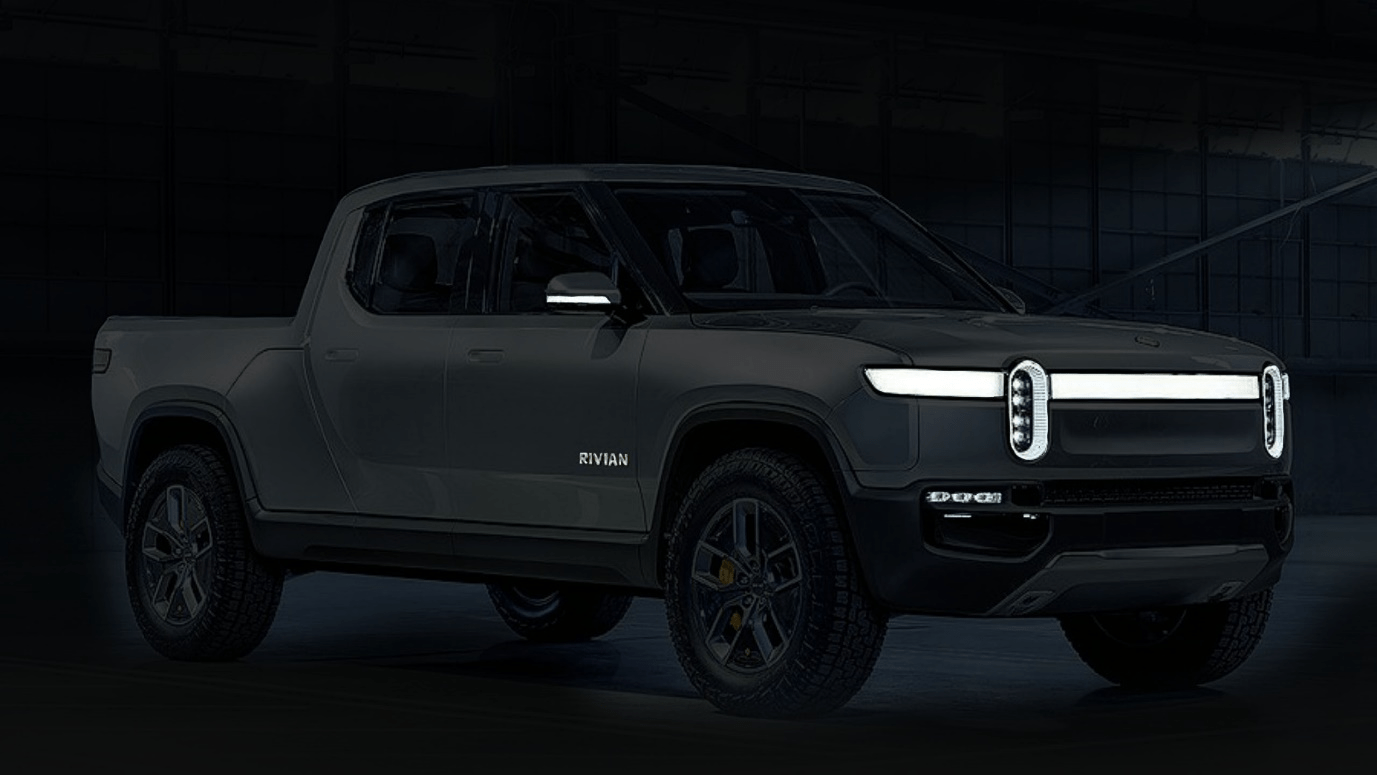

According to public documents, a wholly-owned subsidiary of Ford called Troy Design, and Manufacturing also has a contract to supply Rivian’s R1 vehicle program.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy