March 2, 2023: In February, the U.K. house prices declined by 1.1% yearly, their first annual decline since June 2020 and the largest contraction since November 2012, a widely-watched report from building society Nationwide stated.

February expresses a 0.5% every month decrease, with prices now 3.7%, much less than their August 2022 peak, as higher mortgage prices and a cost-of-living crisis continued to deter homebuying.

“The latest run of weak house price data started with the financial market turbulence in reply to the mini-Budget at the September-end in the previous year,” said Nationwide Chief Economist Robert Gardner in a press release.

“While financial market conditions normalised a few time ago, housing market activity has remained subdued.”

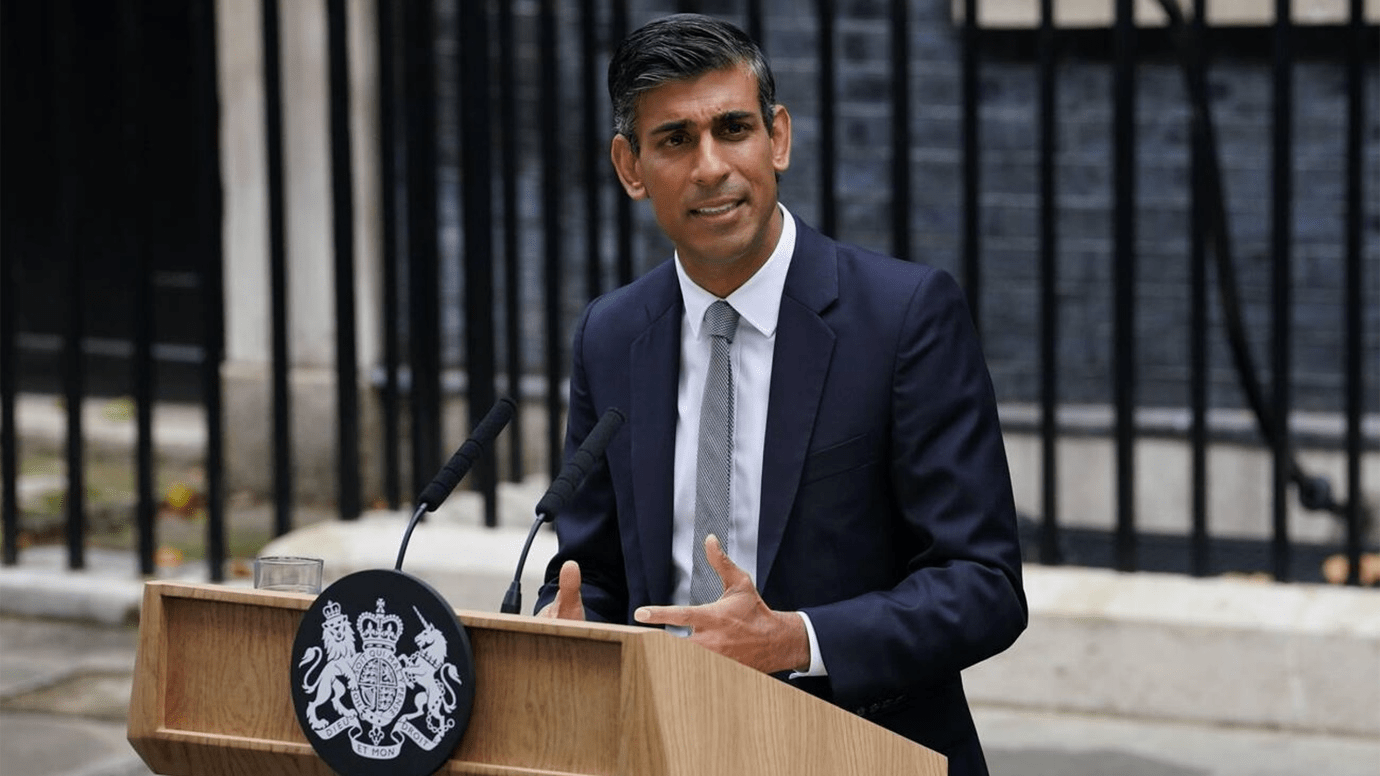

Mortgage prices soared in September 2022 following former Prime Minister Liz Truss’ disastrous tax-cutting “mini-budget”, which prompted a sell-off in the U.K. administration bond market, eventually which lends to a Bank of England intervention and Truss’ resignation following over 44 days in office.

Gardner explained that February’s decrease likely reflects the lingering damage to the confidence and squeeze on household revenue. Inflation continues to outpace salary growth, and mortgage rates substantially increased to their 2021 lows.

“It will be tough for the market to have much momentum in the near term since economic headwinds are wanting to remain relatively strong, with the labour market widely anticipated to weaken as the economy decreases in the quarters ahead, while mortgage prices remain well above the lows prevailing in 2021,” he stated.

Mortgage transactions on a typical home remain well above the long-run average as a share of take-home pay for a prospective first-time buyer revenue the average income, Nationwide noted.

Therefore, deposit requirements remain “prohibitively high” because of the increasing cost of living and a steep increase in private renting prices.

On Wednesday, the latest Bank of England figures showed U.K. mortgage approvals decreased in January to their lowest since 2009, which excludes the Covid-19 pandemic period, with a net mortgage which lends to individuals decreasing to £2.5 billion from £3.1 billion in December.

Net mortgage approvals decreased for a fifth consecutive month to 39,600, the less since January 2009, ex the pandemic era in which the housing market came to a standstill.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy