November 17, 2021: According to court filings out Monday, JP Morgan Chase filed suit against electric vehicle maker Tesla in a dispute over warrants. The bank is seeking $162.2 million plus interest, attorneys’ fees, and expenses.

JP Morgan is alledged that Tesla has breached the terms of a contract the companies signed about re-pricing the warrants.

The complaint says that Tesla was supposed to deliver shares or cash if its share price went over a contractually set “strike price” by a specific expiration date.

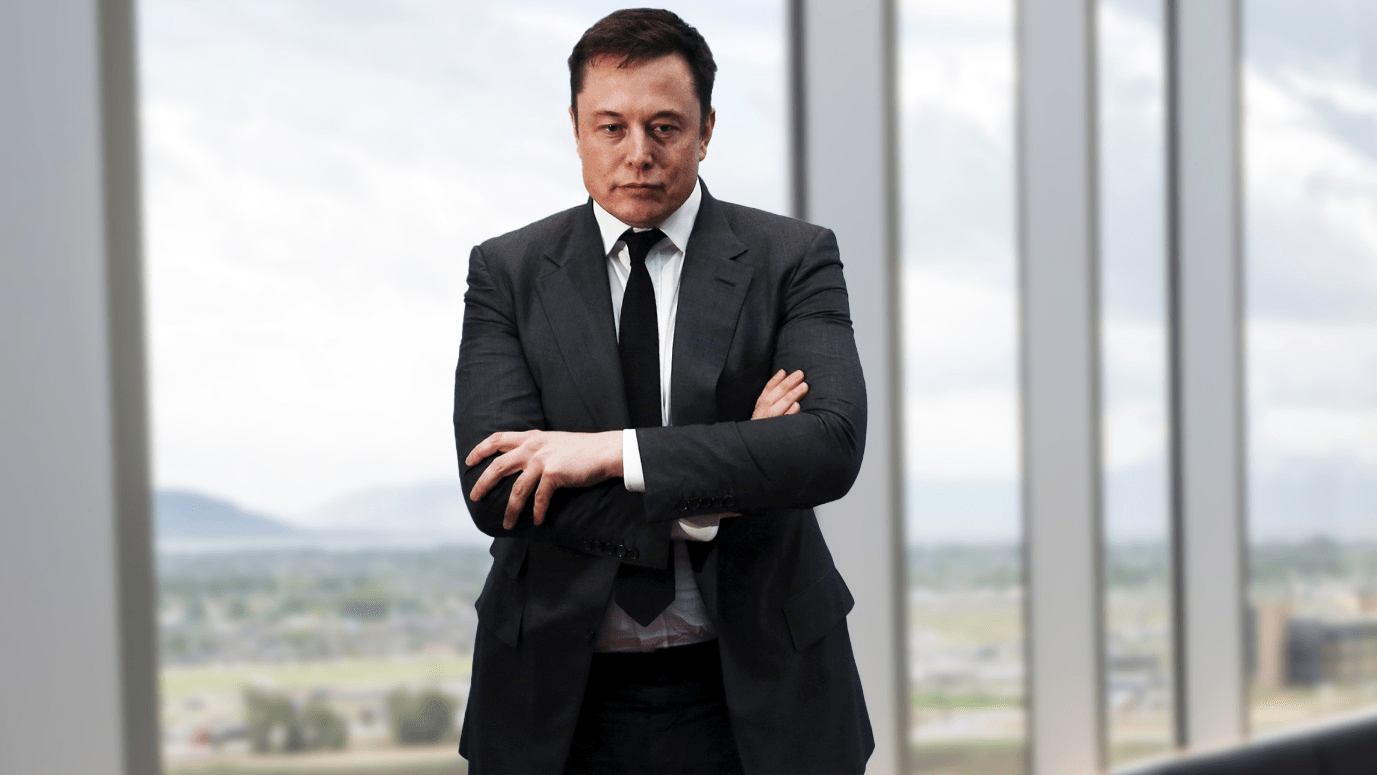

But a dispute was raised when JP Morgan adjusted the value of the warrants when Tesla CEO Elon Musk tweeted in August 2018 that he was considered private for $420 a share and rescinded the idea of privatizing Tesla some weeks later.

JP Morgan is claiming it had a contractual right to make those adjustments. At the same time, Tesla said in a letter that they were “unreasonably swift and represented an opportunistic attempt to take advantage of changes in volatility in Tesla’s stock,” according to the filing.

In the 16 months that followed, Tesla stock bottomed out at a three-year low of under $177 per share in June 2019, before the past $420 per share in December that year. Musk was charged with securities fraud by the SEC, and Tesla and Musk agreed to pay $20 million each to settle the suit.

Tesla shares closed on November 15 at $1,013.39. The complaint says, “In total, Tesla is failing to deliver 228,775 shares of its common stock, which leaves JPMorgan with an open hedge position equal to that shortfall.”

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy