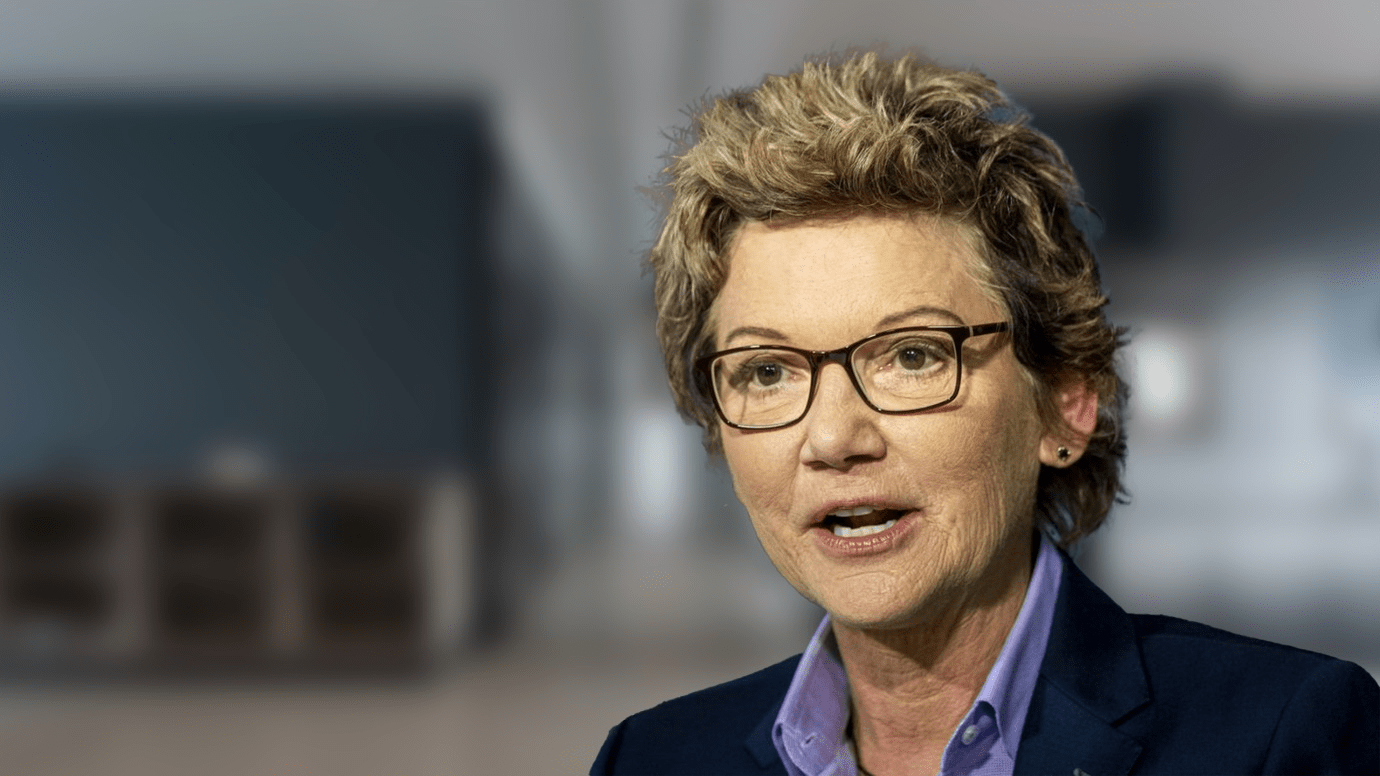

September 29, 2022: -On Tuesday, San Francisco Federal Reserve Bank President Mary Daly said that the U.S. central bank is “resolute” about decreasing high inflation but is willing to do so “as gently as possible” so as not to drive the economy down.

It is essential, Daly said at a symposium jointly with the Monetary Authority of Singapore, “navigate through this high inflation environment very carefully we can see so that we are not leaving long-term damage to our labor market.”

The Fed has been growing interest rates to bring down inflation that is more than three times its 2% target. The previous week’s rate rise of 75 basis points was the central bank’s third straight increase of that size, and it is signaling it would lift the policy rate, currently in the 3%-3.25% range, to 4.4% by year-end 4.6% next year.

Fed Chair Jerome Powell has said that raising rates at that pace will push up unemployment and be painful for a few households and businesses. Still, ultimately it would be more painful to permit inflation to get entrenched.

“Price stability is fundamental,” Daly said. U.S. inflation is half due to excess demand and a half because of the constrained supply, she said, and the hope is that as the Fed increases rates to slow the market, the supply side will also heal, which permits the two to “meet in the middle.”

But supply chains are tangling, and labor supply is not returning as quickly as had been hoped, she said, so the Fed may need to do “a little more” on demand to ensure inflation does come down.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy