February 24, 2023: On Thursday, U.S. Treasury yields increased as investors digested the latest Federal Reserve talk minutes and considered the central bank’s interest rate policy viewpoint.

The yield on the Treasury was up three basis points at 3.951%. The 2-year Treasury was up one basis point at 4.712%.

Yields and prices have a relationship, and one basis point equals 0.01%.

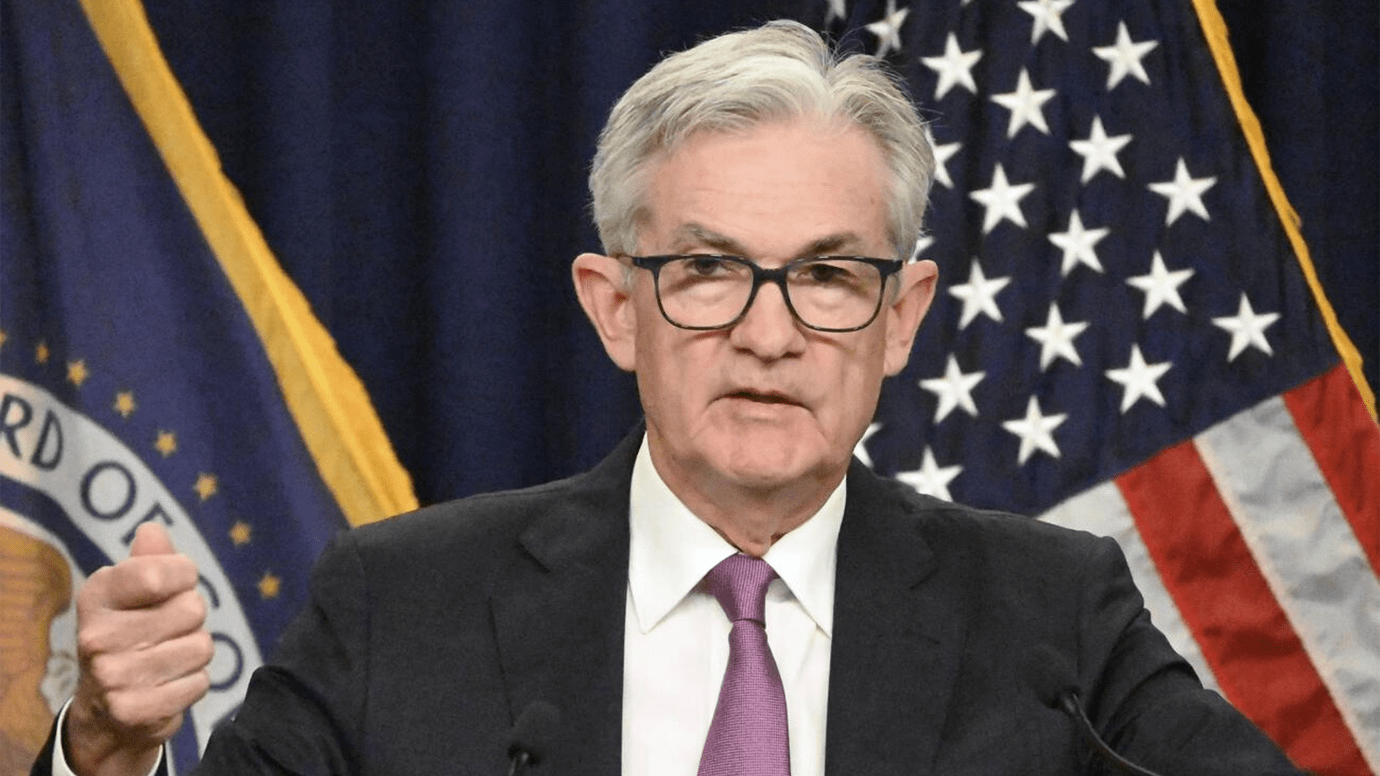

Just from the Fed’s previous meetings on January 31 and February 1, published, showed that while there were signs of inflation being controlled, central bank officials were still concerned about increasing prices. They noted that further interest price hikes are likely.

The Fed increased interest prices by 25 basis points at its previous meeting, marking the eighth consecutive rate hike.

Many investors expect the central bank to pause price increases this year as fears that the elevated prices would lead to an economic contraction have spread.

St. Louis Fed President James Bullard fought for further price increases on Wednesday.

On Thursday, investors will look to further Fed speakers, including Atlanta Fed President Raphael Bostic, for fresh hints regarding the path ahead for interest prices.

The data front stated that the initial jobless claims data will be done on Thursday, and the personal consumption expenditure costs index is expected Friday.

The consumer spending gauge reflects the amount spent on goods and is one of the Fed’s favoured inflation measures.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy