May 26, 2021:-On Wednesday, Wall Street has high expectations for Ford Motor’s first investor day under CEO Jim Farley.

The stock price of the company has doubled since Farley took control of the company on Oct. 1. Including a 12.6% increase last week after the debut of the company’s new electric F-150 Lightning pickup truck.

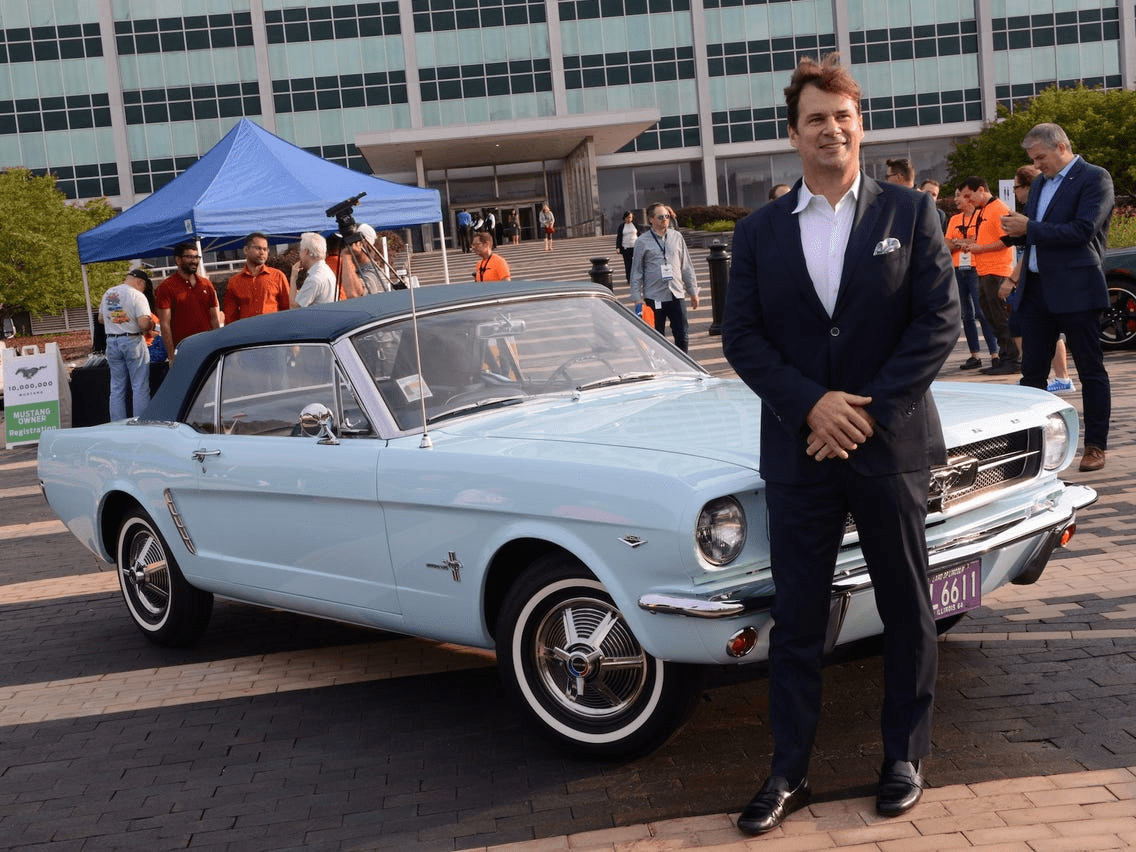

Investors will be watching the highly anticipated investor event to see if Farley can keep up the momentum. He has promised to provide details of his management team’s direction for the automaker.

Farley’s predecessor, Jim Hackett, was criticized by Wall Street for failing to detail his turnaround plan and having an unclear vision to fix Ford’s operations. Farley’s plan will have to be described to appease Wall Street.

“Since Jim Farley has taken over as CEO, Ford has promised increased transparency and measurable [key performance indicators] so we can track Ford’s progress and execution,” RBC Capital Markets analyst Joseph Spak said in a note. “We expect those, along with financial targets, to be detailed at the event.”

Other expectations range from a clear path for the company to achieve an 8% adjusted profit margin to new details regarding its plans for electric and autonomous vehicles. Here is additional information on those items and more.

An ongoing promise of Farley has been providing clear financial targets that Wall Street can measure the company’s progress against.

One of the top targets analysts want to see is a long-promised 8% global adjusted profit margin target, including 10% in North America and 6% in Europe. The 8% was promised by Hackett and his predecessor, Mark Fields, as part of a “2020 vision” that never happened.

“We’ll look for an update, and a bridge to Ford’s prior 8% margin target,” Citi analyst Itay Michaeli said in a note Friday. “The more details, the better. Though consensus out-year estimates appear in-line with Ford’s 8% target, the Investor Day serves an opportunity to build greater confidence.”

Before the Covid-19 pandemic, Ford’s adjusted profit margin was 4.1% in 2019, followed by 2.2% in 2020. Due to an imbalance of supply and demand in new vehicles due to an ongoing global semiconductor chip shortage, it was inflated to 13.3% during the first quarter of this year.

For comparison, General Motors’ adjusted profit margin was 6.1% in 2019, 7.9% in 2020, and 13.6% during the first quarter of this year.

Wells Fargo analyst Colin Langan expects Ford to reaffirm its long-term margins at the event and mainly focus on the “future mobility themes” such as electric and autonomous vehicles and data monetization.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy