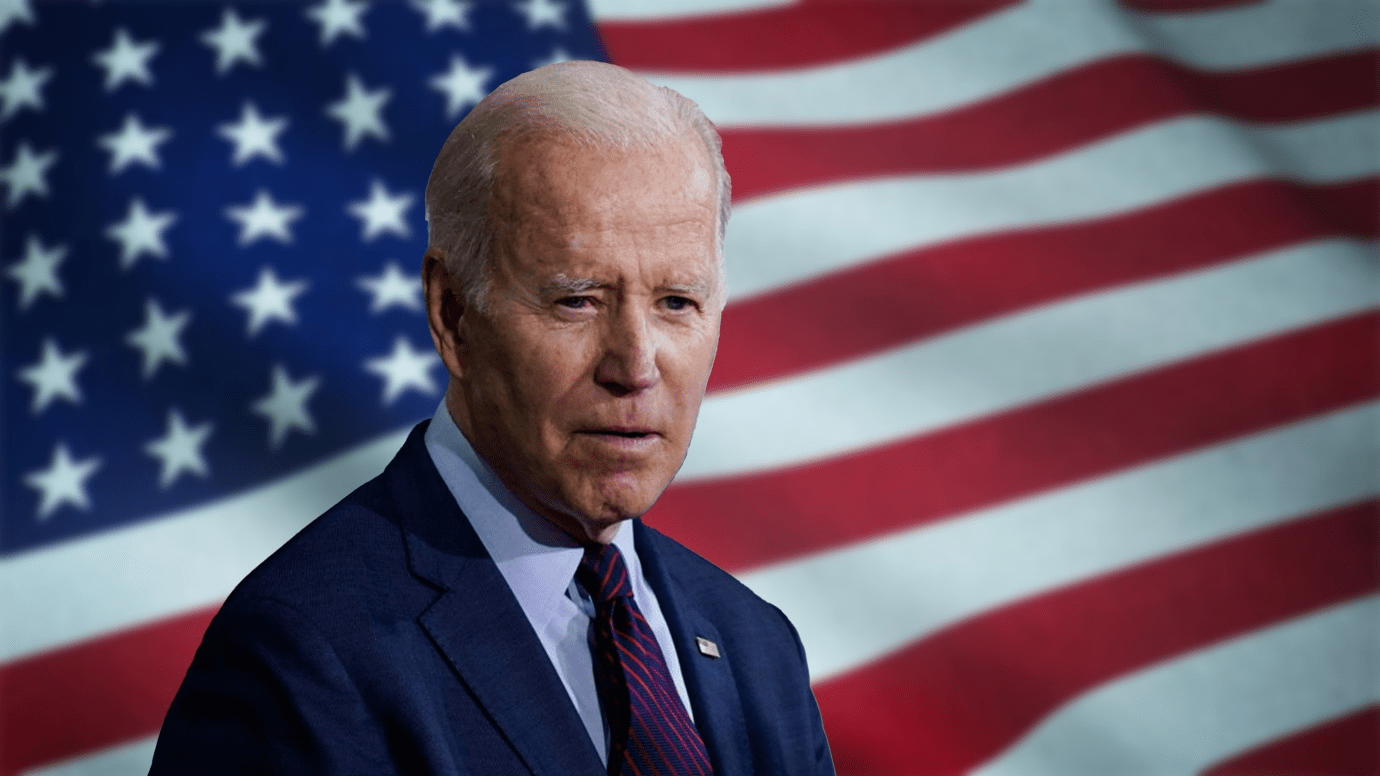

August 26, 2022: -On Wednesday, President Joe Biden announced that he would forgive $10,000 in federal student debt for most borrowers, fulfilling a campaign pledge and is delivers financial relief to millions of Americans.

Biden will cancel up to $20,000 for recipients of Pell Grants.

“Both of these targeted actions are for families who want it the most,” the president said in remarks from the White House.

The relief will be limited to Americans earning under $125,000 per year or $250,000 for married couples or heads of households. The reserve is also capped at the amount of a borrower’s outstanding eligible debt, per the Education Department.

According to the tweet, the president will also extend the payment pause on most federal student loans “one final time” through December 31, 2022.

In his remarks, Biden said that 95% of borrowers would benefit from the plan or about 43 million people. Of those, over 60% are Pell Grant recipients.

In all, Biden said that nearly 45% of borrowers, or almost 20 million people, would have their debt fully canceled.

“That’s 20 million people who can start getting on with their lives,” Biden said.

“All of this means people can finally start to crawl out from under that mountain of debt. To get on top of their rent and their utilities. Finally, think about buying a home, starting a family, or starting a business.”

According to higher education expert Mark Kantrowitz, Biden’s decision to move ahead with $10,000 in student obligation cancellation for borrowers under $125,000 will cost the federal government around $244 billion. The $20,000 relief for Pell Grant recipients may add around $120 billion to the government’s costs.

The unprecedented action by the White House of wiping out hundreds of billions of dollars in consumer obligation follows years of advocacy pressure and recent months of heated debate among Biden administration officials.

Those discussions centered on how student loan forgiveness might impact the high inflation hitting Americans’ wallets, the amount of student debt that should be canceled, and if the president even had the power to reduce people’s balances without the legislative branch.

Looming November midterm elections added pressure on the administration to arrive at a decision. Advocates have said that forgiving student debt choices galvanize younger voters to the polls, among whom Biden has been losing popularity.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy