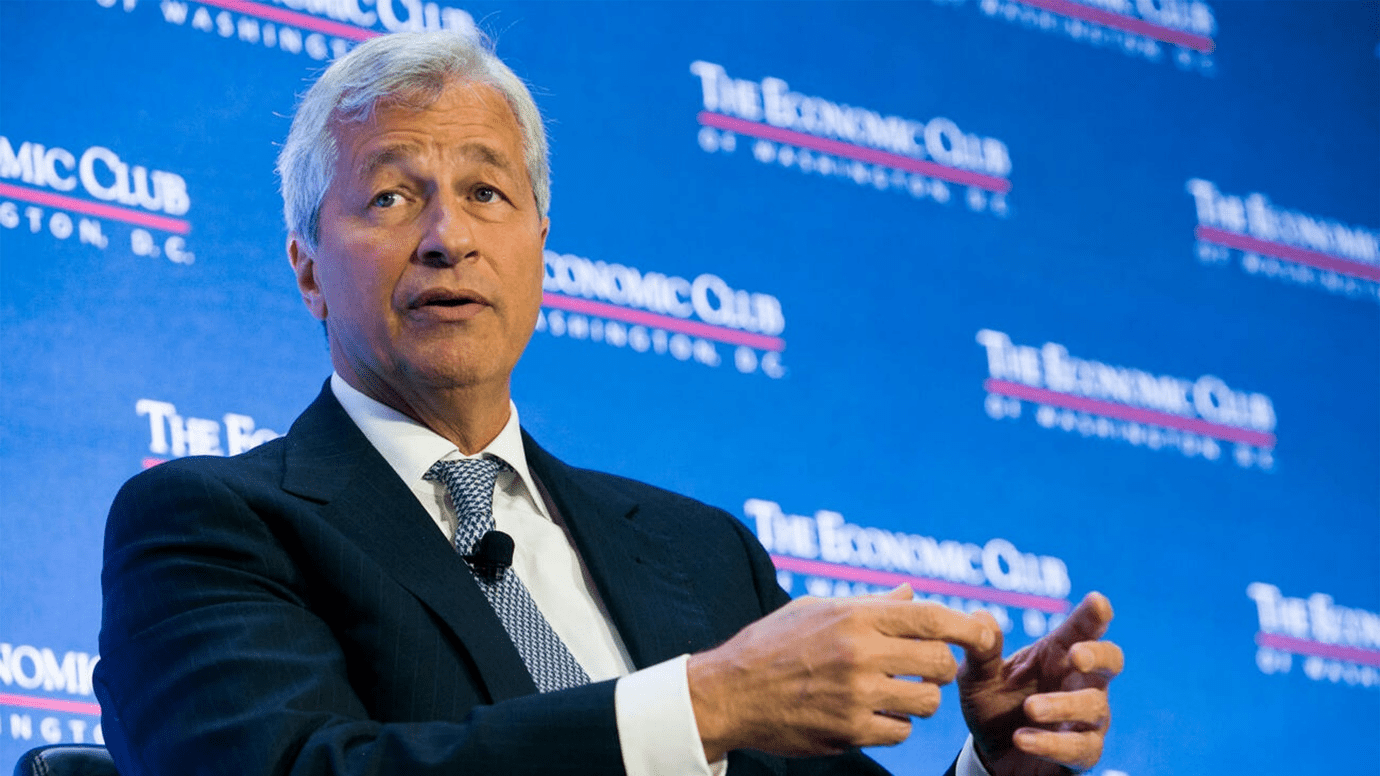

February 27, 2023: On Thursday, JPMorgan CEO Jamie Dimon said that containing inflation a result in improvement for the Federal Reserve while stating that the U.S. economy resumed showing signs of strength.

“I have all the anticipate for Powell, but we are losing a little bit of control of inflation,” Dimon stated in an interview during the “Halftime Report.” It’s the first two-part interview with Cramer, with the second instalment circulating later on Thursday.

Dimon’s observations came one day following the Fed released the minutes from its Jan. 31-Feb.1 meeting, showing members remain resolved to fight persistent inflation.

“Parties stated that inflation data received over the past three months show a welcome reduction in the monthly speed of price wave but stressed that substantially more proof of progress across a broader range of costs would be required confidently that inflation was on a sustained decreasing path,” the minutes said.

Dimon said he expects that interest rates could “possibly” remain increased for longer, as it may take the central bank “a while” to reach its aim of 2% inflation.

Hence, the JPMorgan CEO said he’s not presently breaking out of the slump playbook, as the strength of the U.S. economy boosts him.

“The U.S. economy currently is doing quite well. Consumers have a lot of money. They’re spending it. Jobs are plentiful,” Dimon stated. “That’s today. Out in front of us, there’s a few scary stuff. You and I know there’s always uncertainty. That’s a normal thing.”

Those words contrast with Dimon’s most delinquent remarks in October. In December, he stated higher inflation was deteriorating consumer wealth, which would lead to a recession this year. He said the U.S. economy would likely slump in six to nine months.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy