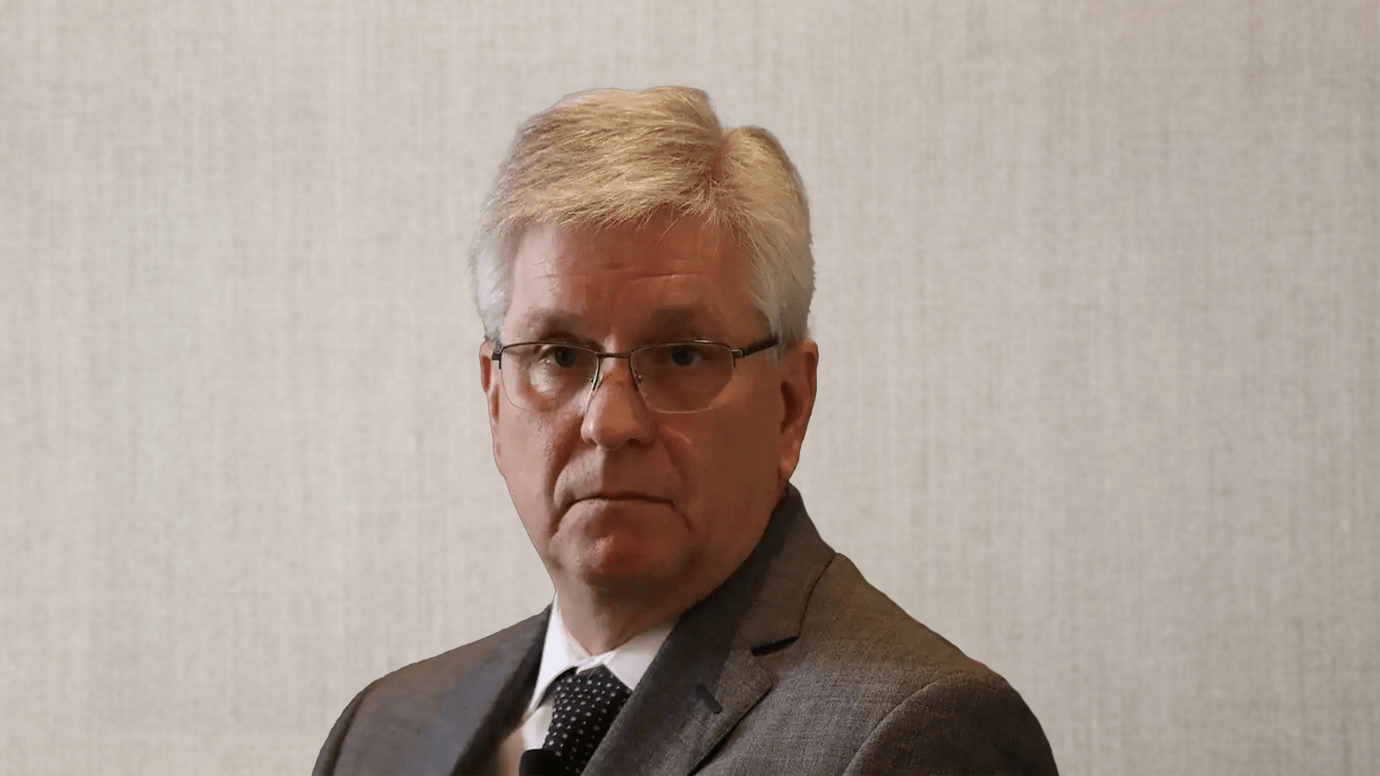

September 13, 2022: -Federal Reserve Governor Christopher Waller echoed recent sentiments from his colleagues, saying he expects a huge interest rate increase later this month.

He also said policymakers should stop guessing the future and instead stick to what the data said.

“Looking ahead to our meeting, I support one more significant increase in the policy rate,” Waller added in remarks prepared for a speech in Vienna. “But, it looks further out, I can’t tell you regarding the appropriate policy path. The peak range and the fast we will move there will depend on data we will receive about the economy.”

Those comments are similar to the latest remarks from Fed Chair Jerome Powell, Vice Chair Lael Brainard, and others, who said they are relentless in bringing down inflation.

Markets expect the central bank to take up its benchmark, which borrows rate by 0.75 percent point, being the third consecutive move of that volume and the fastest speed of monetary tightening since the Fed started to use the benchmark funds rate as its chief policy tool in the early 1990s.

While Waller is not committing to a certain increase, his comments had a hawkish tone that indicated he would support the 0.75-point move instead of a half-point rise.

“Based on all of the data we have received since the FOMC’s previous meeting, I believe the policy decision at our meeting will be straightforward,” he added. “Because of the strong labor market, there is no tradeoff between the Fed’s employment and inflation objectives, so we will continue to fight inflation aggressively.

If the Fed does apply the three-quarter point hike, it will take benchmark rates up to a range of 3%-3.25%. Waller said that if inflation does not decrease through the rest of the year, the Fed may have to take the rate “above 4%.”

He then suggested the Fed avoid providing “forward guidance” on its future path and the factors that would come into play to assist those moves.

“I believe forward guidance becomes less useful at this stage of the tightening cycle,” he stated. “Future decisions on the size of a rate which elevates and the goal for the policy rate in this cycle should be solely said by the incoming data and their actions for economic activity, employment, and inflation,” he added.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy