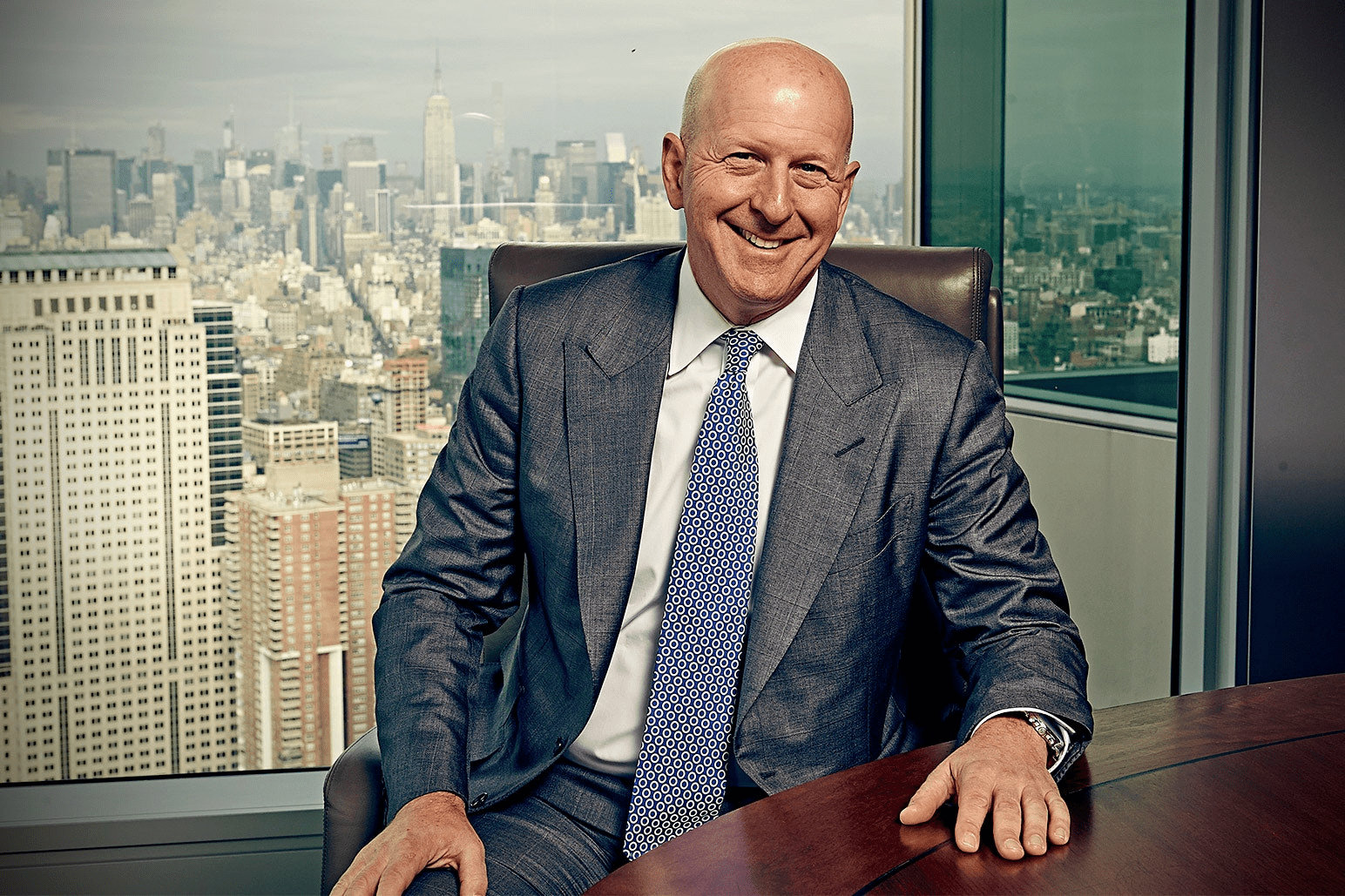

July 15, 2021: -Goldman Sachs CEO David Solomon said that recent moves of China boosting oversight of its technology industry surprised him and will likely delay “a large number” of companies from listing shares in the U.S.

In the previous week, shares of riding-hailing giant Didi Global plunged after China announced that new users couldn’t download the app between a cybersecurity review. Chinese regulators had advised Didi to postpone its U.S. listing, but the tech company went ahead with it in the previous month, The Wall Street Journal reported.

“There’s a significant backlog of Chinese companies that are turning to global capital to introduced money to support their growth, and we have our backlog, a large number of companies that plan to come to the U.S. market,” Solomon told CNBC on Tuesday.

“Because of the actions the Chinese government has taken, I think some of those companies will not come to market at this point,” Solomon said, adding it was too early to tell what the long-term impacts would be.

As head of arguably the premier global Wall Street advisory firm, Solomon should navigate the rising fraught relationship between China, its giant technology firms, and the rest of the world. Goldman, along with JPMorgan Chase and Morgan Stanley, were lead underwriters on Didi’s U.S. listing.

“I was surprised that this played out the way it did, at this moment in time, but we’re engaged with regulators around the world,” Solomon added.

“I think it’s early to see how exactly the shift will balance over time, but there’s no question the Chinese want more control of the direction of some of this listing activity, and so they’re taking steps that will give them more control,” Solomon further said.

The New York-based bank posted results that handily beat expectations earlier Tuesday, helped by substantial revenue from Wall Street advisory activities.

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy