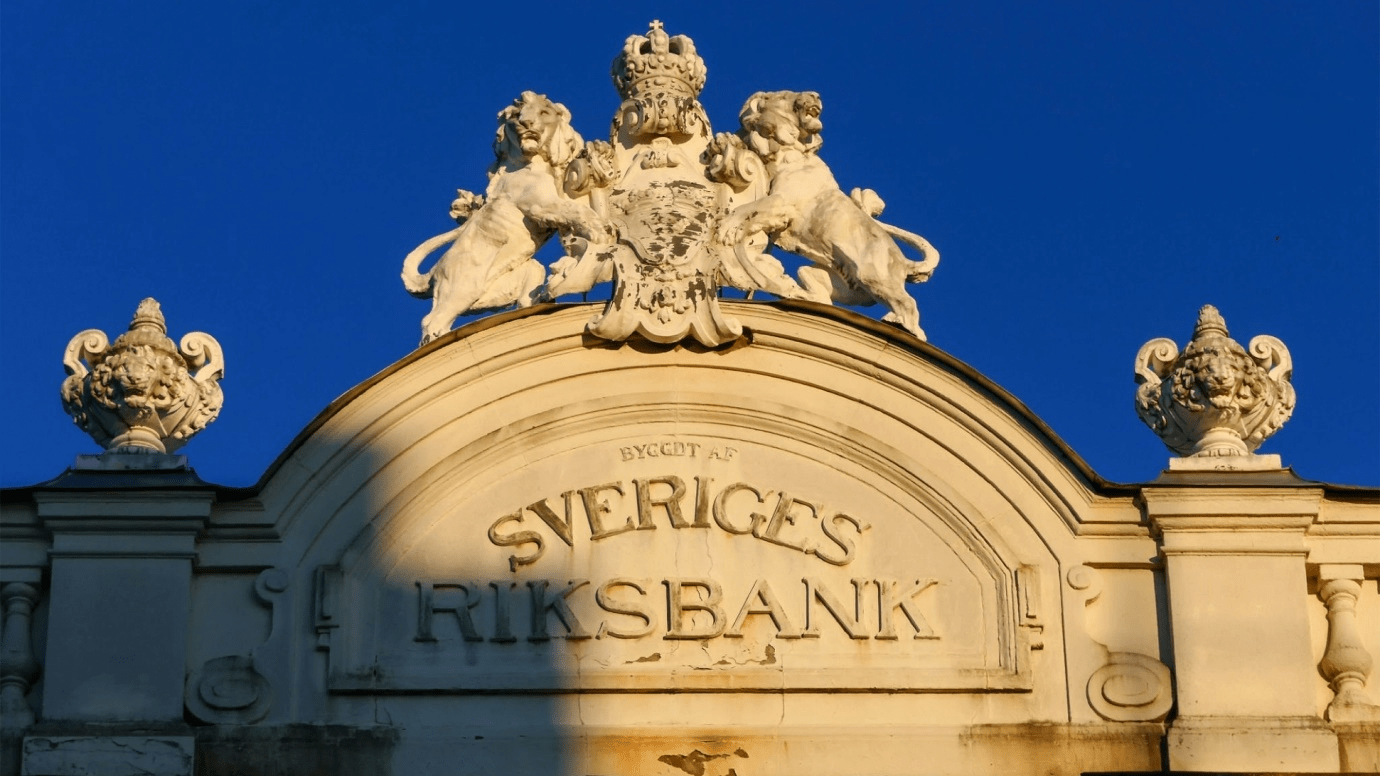

April 27, 2023: On Wednesday, Sweden’s central bank increased its policy rate by half a percentage point to nearly 3.50%, in line with market forecasts and stated it was nearly done with policy tightening.

With inflation at almost 30-year highs, central banks have raised prices aggressively in recent quarters. The pace of hikes has slowed as rate-setters eye financial market turmoil and slowing economies. But their job still needs to be completed.

“Following the rapid policy rate hikes more than the previous year, monetary policy has a tightening effect economy, and the Executive Board considers that following the April meeting, there will be scope to adjust the policy rate in steps,” the central bank stated in a statement.

While the half-percentage point hike aligned with forecasts, markets cut their anticipation of where the Riksbank policy price will peak to around 3.75% from close to 4.0% before the decision.

“Either the Riksbank knows something more regarding inflation than the rest of us does, or they believe that inflation will decrease sharply during the two quarters,” Lars Kristian Feste, head of fixed income at Ohman Fonder, stated.

Underlying inflation in Sweden at 8.9% has begun to ease but remains far over the 2% target, and there it could stay high longer than currently expected.

The Swedish crown weakened following the announcement, an unwelcome growth for the ce

© THE CEO PUBLICATION 2021 | All rights reserved. Terms and condition | Privacy and Policy